Abstract

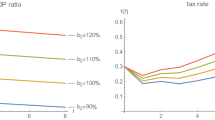

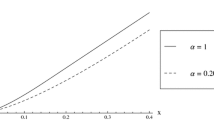

The reduction of government debt to 60% of the GDP in order to satisfy the requirements of the Maastricht Treaty for participation in the European Monetary Union is one of the primary economic-policy goals for most of the European Union countries. The first aim of the present paper is to characterize the optimal path of the primary surplus that leads to the achievement of this Maastricht target. Using optimal-control theory we are able to determine an upper bound of the public-debt-to-GDP ratio above which no retrenchment policy becomes effective. The second issue taken up is that of the sensitivity analysis with respect to the initial level of the debt-to-GDP ratio, the growth rate of the economy, the interest rate, the inflation rate, and the inverse of the velocity of the monetary base circulation.

Similar content being viewed by others

References

van Aarle, B., Bovenberg, A. L., and Raith, M. G. (1997): “Is There a Tragedy of a Common Central Bank? A Dynamic Analysis.”Journal of Economic Dynamics and Control 21: 417–477.

Ball, L., and Mankiw, N. G. (1995): “What Do Budget Deficits Do?” NBER Working Paper 5263, National Bureau of Economic Research, Cambridge, Mass.

Barro, R. J. (1990): “Government Spending in a Simple Model of Endogenous Growth.”Journal of Political Economy 98: 103–125.

Blanchard, O. J. (1984): “Current and Anticipated Deficits, Interest Rates and Economic Activity.”European Economic Review 25: 7–27.

Calvo, G. A., and Leidermann, L. (1992): “Optimal Inflation Tax under Precommitment: Theory and Evidence.”American Economic Review 82: 179–194.

Corsetti, G., and Roubini, N. (1992): “Tax Smoothing Discretion versus Balanced Budget Rules in the Presence of Politically Motivated Fiscal Deficits: the Design of Optimal Fiscal Rules for Europe after 1992.” Discussion Paper 682, Center for Economic Policy Research, London.

Feichtinger, G., and Hartl, R. F. (1986):Optimale Kontrolle ökonomischer Prozesse: Anwendungen des Maximumprinzips in den Wirtschaftswissenschaften. Berlin: deGruyter.

Fischer, S., and Modigliani, F. (1978): “Toward an Understanding of the Real Effects and Costs of Inflation.”Weltwirtschaftliches Archiv 114: 810–833.

Flaschel, P., and Groh, G. (1996):Keynesianische Makroökonomik: Unterbeschäftigung, Inflation und Wachstum. Berlin: Springer.

Frisch, H. (1994): “Government Debt and Sustainable Fiscal Policy.” Paper presented at the Monte dei Paschi “Economic Notes” Workshop ”Coping with Financial Instability,” November 23 and 24, Siena.

Frisch, H., and Hof, F. X. (1996): “The Algebra of Government Debt.” Working Paper, Institute of Economics, University of Technology Vienna, Vienna.

Greiner, A., and Semmler, W. (1997): “Endogenous Growth, Government Debt and Budgetary Regimes.” Working Paper, New School of Social Research, New York.

Jones, L. E., and Manuelli, R. (1990): “A Convex Model of Equilibrium Growth: Theory and Policy Implications.”Journal of Political Economy 98: 1008–1038.

Jones, L. E., Manuelli, R. E., and Rossi, P. E. (1993): “Optimal Taxation in Models of Endogenous Growth.”Journal of Political Economy 101: 485–517.

King, R. G., and Rebelo, S. (1990): “Public Policy and Economic Growth: Developing Neoclassical Implications.”Journal of Political Economy 98: 126–150.

Kraus, D. (1997): “13 Staaten erfüllen die Maastricht-Kriterien.”Die Presse, April 24th: 22.

Lockwood, B., Philippopoulus, A., and Snell, A. (1996): “Fiscal Policy, Public Debt Stabilisation and Politics: Theory and UK Evidence.”Economic Journal 106: 894–991.

Mankiw, N. G. (1987): “The Optimal Collection of Seigniorage: Theory and Evidence.”Journal of Monetary Economics 20: 327–341.

Prskawetz, A. (1998): “Optimal Fiscal Policy and the Maastricht Criteria.”Mathematical Modelling of Systems (forthcoming).

Rebelo, S. (1991): “Long-run Policy Analysis and Long-run Growth.”Journal of Political Economy 99: 500–521.

Stemp, P. J. (1997): “Zero Inflation Targets: Central Bank Commitment and Fiscal Policy Outcomes.” Working Paper, Department of Economics, University of Melbourne, Melbourne, Victoria.

Tabellini, G. (1986): “Money, Debt and Deficits in a Dynamic Game.”Journal of Economic Dynamics and Control 10: 427–442.

Turnovsky, S. J. (1995):Methods of Macroeconomic Dynamics. Cambridge, Mass.: MIT Press.

Winckler, G., Hochreiter, E., and Brandner, P. (1996): “Deficits, Debt and European Monetary Union.” Working Paper 9615, Department of Economics, University of Vienna, Vienna.

Wöhrmann, D. I. A. (1996): “Fiscal Policy in a Lucasian General Equilibrium with Productive Government Spending.” Working Paper no. 27, Faculty of Economics and Management, Otto-von-Guericke-University Magdeburg, Magdeburg.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Prskawetz, A., Feichtinger, G. & Luptàčik, M. The accomplishment of the Maastricht criteria with respect to initial debt. Zeitschr. f. Nationalökonomie 68, 93–110 (1998). https://doi.org/10.1007/BF01237186

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01237186