Abstract

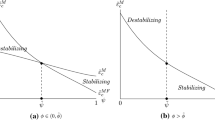

This paper considers a closed macroeconomy where the monetary authority pursues an inflation target and policy outcomes are the consequence of a Nash game between fiscal and monetary authorities. The specification of the macroeconomic framework is characterized by nonlinearities which lead to multiple equilibria with differing stability properties. Employing a calibrated model and simulations derived using the Mathematica package, the stability properties of the economy and the likely choice of equilibrium are examined. Within this framework, the dynamic consequences of different time discount rates for the fiscal authority are investigated, both in a world of certainty and also in a world of uncertainty. It is shown that, in a world of certainty, it will be optimal to choose the fiscal authority's time discount rate equal to the market rate of interest. However, depending on the degree of uncertainty in evaluating the time discount rates of consumers and of the fiscal authority, it may be appropriate to bias the fiscal authority's discount rate above or below the expected interest rate.

Similar content being viewed by others

References

Barro, R., and Gordon, D. (1983a): “Rules, Discretion and Reputation in a Model of Monetary Policy.”Journal of Monetary Economics 12: 101–122.

—, (1983b): “A Positive Theory of Monetary Policy in a Natural Rate Model.”Journal of Political Economy 91: 589–610.

Basar, T., and Olsder, G. J. (1982):Dynamic Noncooperative Game Theory. London: Academic Press.

DeLong, B., and Summers, L. H. (1986): “Is Increased Price Flexibility Destabilizing?”American Economic Review 76: 1031–1044.

King, M. (1996): “How Should Central Banks Reduce Inflation? Conceptual Issues.” InAchieving Price Stability, a Symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, August 29–31, 1996.

Mankiw, N. G., and Summers, L. H. (1986): “Money Demand and the Effects of Fiscal Policies.”Journal of Money, Credit and Banking 18: 415–429.

Ramsey, F. P. (1928): “A Mathematical Theory of Saving.”Economic Journal 38: 543–559.

Wolfram, S. (1996):The Mathematica Book, 3rd ed. Champaign, Ill. /Cambridge: Wolfram Media/Cambridge University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Stemp, P.J. The government's time discount rate: Choices and consequences in a dynamic framework. Journal of Economics Zeitschrift für Nationalökonomie 67, 265–285 (1998). https://doi.org/10.1007/BF01234646

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01234646