Abstract

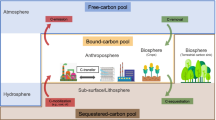

We recognize that carbon-containing products do not decay and release CO2 to the atmosphere instantaneously, but release that carbon over extended periods of time. For an initial production of a stock of carbon-containing product, we can treat the release as a probability distribution covering the time over which that release occurs. The probability distribution that models the carbon release predicts the amount of carbon that is released as a function of time. The use of a probability distribution in accounting for the release of carbon to the atmosphere realizes a fundamental shift from the idea that all carbon-containing products contribute to a single pool that decays in proportion to the size of the stock. Viewing the release of carbon as a continuous probabilistic process introduces some theoretical opportunities not available in the former paradigm by taking advantage of other fields where the use of probability distributions has been prevalent for many decades. In particular, theories developed in the life insurance industry can guide the development of pricing and payment structures for dealing with the costs associated with the oxidation and release of carbon. These costs can arise from a number of proposed policies (cap and trade, carbon tax, social cost of carbon, etc), but in the end they all result in there being a cost to releasing carbon to the atmosphere. If there is a cost to the emitter for CO2 emissions, payment for that cost will depend on both when the emissions actually occur and how payment is made. Here we outline some of the pricing and payment structures that are possible which result from analogous theories in the life insurance industry. This development not only provides useful constructs for valuing sequestered carbon, but highlights additional motivations for employing a probability distribution approach to unify accounting methodologies for stocks of carbon containing products.

Similar content being viewed by others

References

Bowers NL et al (1997) Actuarial mathematics, 2nd edn. The Society of Actuaries, Schaumburg

Buhlmann H (1970) Mathematical methods in risk theory. Springer, Berlin

Cunningham R, Herzog T, London R (2008) Models for quantifying risk, 3rd edn. Actex Publications, Winsted

Federal Agency Working Group (2010) Appendix 15A: Social cost of carbon for regulatory impact analysis under executive order 12866. Available online at http://www2.eere.energy.gov/buildings/appliance_standards/commercial/pdfs/sem_finalrule_appendix15a

Furman E, Zitikis R (2009) Weighted pricing functionals with applications to insurance: an overview. N Am Actuar J 13(4):483–496

Gerber HU (1979) An introduction to mathematical risk theory. University of Pennsylvania Press, Philadelphia

Goovaerts MJ, de Vylder F, Haezendonck J (1984) Insurance premiums: theory and applications. North-Holland, Amsterdam

IPCC (1997) In: Houghton JT, Meira Filho LG, Lim B, Treanton K, Mamaty I, Bonduki Y, Griggs DJ, Callandar BA (eds) Revised 1996 IPCC guidelines for national greenhouse gas inventories. Intergovernmental Panel on Climate Change

IPCC (2007) 2006 IPCC guidelines for national greenhouse gas inventories. Intergovernmental Panel on Climate Change

Lombardi LJ (2006) Valuation of life insurance liabilities, 4th edn. Actex Publications, Winsted, pp 1–2

Marland E, Marland G (2003) The treatment of long-lived, carbon containing products in inventories of carbon dioxide emissions to the atmosphere. Environ Sci Policy 6(2):139–152

Marland ES, Stellar K, Marland GH (2010) A distributed approach to accounting for carbon in wood products. Mitig Adapt Strateg Glob Change 15:71–91

National Research Council (2010) Verifying greenhouse gas emissions: methods to support international climate agreements. US National Research Council of the National Academies, The National Academies Press, Washington DC

Pingoud K, Perälä A-L, Soimakallio S, Pussinen A (2003) Greenhouse gas impacts of harvested wood products: evaluation and development of methods. VTT Research Notes 2189, VTT, Espoo, Finland

Stern N (2007) The economics of climate change; the Stern report. Cambridge University Press, Cambridge, 712 pp

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shirley, K., Marland, E., Cantrell, J. et al. Managing the cost of emissions for durable, carbon-containing products. Mitig Adapt Strateg Glob Change 16, 325–346 (2011). https://doi.org/10.1007/s11027-010-9268-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11027-010-9268-4