Abstract

Is there a role for investments in climate change mitigation despite low expected return? We use a model of intertemporal expected utility maximisation to analyse this question. Similar to the capital asset pricing model (CAPM) the rate of return depends on the correlation of risk between the return on investments in climate change mitigation and the market portfolio, but in contrast to the classical CAPM we admit the fact that economic and environmental systems are jointly determined, implying that environmental risk is endogenous. Therefore, investments in climate change mitigation may reduce risk via self-protection and self-insurance. If risk reduction is accounted for in cost–benefit evaluations, climate investments may be justified despite low expected return. These aspects of climate investments are not, however, communicated via standard cost–benefit analyses of climate policy. Optimal climate policy may therefore be more ambitious than previously considered.

Similar content being viewed by others

References

Barbier ED, Shogren JF (2004) Growth with endogenous risk of biological invasion. Econ Inq 42(4):587–601

Breeden DT (1979) An intertemporal asset pricing model with stochastic consumption and investment opportunities. J Financ Econ 7:265–296

Cline WT (1991) Scientific basis for the greenhouse effect. Econ J 101(407):904–919

Cline WT (2004) Meeting the challenge of global warming. Paper presented for the Copenhagen Consensus program of the National Environmental Assessment Institute, Denmark. http://www.copenhagenconsensus.com/Default.asp?ID=165

Crocker T, Shogren JF (2003) Choosing environmental risk. In: Folmer H, Tietenberg T (eds) International yearbook on environmental and resource economics 2003/2004. Edward Elgar, Cheltenham

Ehrlich I, Becker GS (1972) Market insurance, self-insurance and self-protection. J Polit Econ 80:623–648

Fisher AC, Narain U (2003) Global warming, endogenous risk and irreversibility. Environ Res Econ 25(4):395–416

Gollier C (2001) The economics of risk and time. MIT Press, Cambridge, MA

Howarth RB (2003) Discounting and uncertainty in climate change policy analysis. Land Econ 79(3):369–381

Howarth RB, Norgaard RB (1993) Intergenerational transfers and the social discount rate. Environ Res Econ 3:337–358

Ibbotson Associates (2001) Stocks, bonds, bills and inflation. Ibbotson Associates, Chicago

Kane S, Shogren JF (2000) Linking adaptation and mitigation in climate change policy. Clim Change 45:75–102

Lettau M, Ludvigson S (2001) Resurrecting the (C)CAPM: a cross-sectional test when risk premia are time-varying. J Polit Econ 109(6):1238–1287

Marshall JM (1976) Moral hazard. Am Econ Rev 66(5):880–890

Lind R (1982) A primer on the major issues relating to the discount rate for evaluating national energy options. In: Lind R, Arrow K, Corey GR (eds) Discounting for time and risk in energy policy. John Hopkins University Press, Baltimore

Lintner J (1965) The valuation of risky assets and the selection of risky investments in stock portfolios and capital budgets. Rev Econ Stat 47:13–37

Mehra R, Prescott EC (1985) The equity premium: a puzzle. J Monet Econ 15:145–161

Mossin J (1996) Equilibrium in a capital asset market. Econometrica 35:768–783

Nordhaus WD (1994) Managing the global commons: the economics of climate change. The MIT Press, Cambridge

Nordhaus WD, Boyer J (2000) Warming the world: economic models of global warming. The MIT Press, Cambridge

Rubinstein M (1976) The valuation of uncertain income streams and the pricing of options. Bell J␣Econ 7:407–425

Sandmo A (2000) The public economics of the environment. Oxford University Press, New York

Sharpe WF (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J␣Finance 19:425–442

Shogren JF, Crocker TD (1991) Risk, self-protection, and ex ante economic value. J Environ Econ Manage 20:1–15

Shogren JF, Crocker TD (1999) Risk and its consequences. J Environ Econ Manage 37:44–51

Stein C (1973) Estimation of the mean of a multivariate normal distribution. In: Proceedings of the Prague Symposium on Asymptotic Statistics, September

Weitzman M (1998) Why the far distant future should be discounted at its lowest possible rate. J␣Environ Econ Manage 36:201–208

Weitzman M (2001) Gamma discounting. Am Econ Rev 91:260–271

Acknowledgements

The authors wish to thank Therése Hindman Persson and two anonymous referees for helpful comments. Financial support from the RAMBU program of the Norwegian Research Council is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

This Appendix explains the derivations of the main equations presented in the text, i.e. Eqs. 3, 5, 13 and 14, respectively.

Derivation of Equation (3)

For convenience, first recall the third condition of Eq. 2:

Then, using integration by parts over C 2, the last term of Eq. 2 can be written

since F K (−∞) = F K (∞) = 0 and we assume that u(C 2) is bounded above and below or, more generally, \({\lim_{C_2\to-\infty}u(C_2)F_K (C_2) = \lim_{C_2\to\infty} u(C_2 )F_{K} (C_2) = 0}\). Now we can rewrite Eq. 2:

By applying the covariance identity and rearranging, we get

Then we make use of the Stein–Rubinstein lemma (Stein 1973; Rubinstein 1976), which requires that joint distribution of \({\tilde{R}^{N}}\) and \({\tilde{C}_2}\) is bivariate normal and u(·) is twice differential. Invoking the result on the numerator of the first fraction of Eq. 16, such that \({\hbox{cov}(u^{\prime}(\tilde{C}_2), \tilde{R}^{N}) = Eu^{\prime\prime}(\tilde{C}_2) \hbox{cov}(\tilde{C}_2, \tilde{R}^N)}\) we can rewrite Eq. 16 as

Returning to the second condition of Eq. 2, \({E\left\lfloor u^{\prime} \left(\tilde{C}_2\right)\left(\tilde{R}^{M}-R^{0}\right)\right\rfloor=0}\), and rearranging it, we get

Invoking again the Stein–Rubinstein lemma and recalling the assumption of perfect correlation between \({\tilde{C}_2}\) and \({\tilde{R}^{M}}\), we can write Eq. 18 as

Equation 19 allows us to rewrite Eq. 17 to obtain Eq. 3 in the text.

Derivation of Equation (5)

We have

and

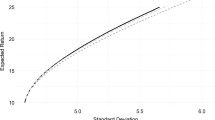

ϕ is the standard normal density function. Consequently,

By definition μ=EC̃2. We assume μ0 is chosen such that it equals actual period two␣expected consumption, i.e., μ0=μ. Inserting this in equation (20) now yields equation (5).

Derivation of Equation (13)

The production function of this model is not constant returns to scale and will therefore generate profit income. We assume that profit is related to investment of K M and define

In words, K N gets its marginal return and K M gets the rest. With these assumptions we obtain

Derivation of Equation (14)

Since \({\tilde\theta_1\sim N(\bar\theta_1(K^N),\sigma_{\theta})}\) and \({{\tilde C}_2=(1-\tilde\theta_1{T^{\theta_2}})Y^*+Y^0+K^M+K^N}\) (equations 8, 9, 12) it follows that \({{\tilde C}_2}\) is normal and we may apply Eq. 5:

First, we develop a simpler expression for β. With \({{\tilde C}_2=Y^0+\tilde Y+K^M+K^N}\) (Eq. 12) we have

From Eq. 21 we know that \({{\tilde R}^N=({\theta_2}{\eta}/T)\tilde DY^*+1,}\) which from Eq. 9 is \({{\tilde R}^N=({\theta_2}{\eta}/T)(Y^*-\tilde Y)+1}\). Inserting in Eq. 23 gives us

Then we develop an expression for \({E{\tilde C'}_2}\). By definition \({E{\tilde C}_2=\int C_2\hbox{d}F_{C_2}(C_2;K^N,\xi)}\). Since, as stated, \({{\tilde C}_2=(1-\tilde\theta_1T^{\theta_2})Y^*+Y^0+K^M+K^N}\), it follows that

From Eq. 25 we get

Assume that \({E{\tilde C}_2\approx E\tilde Y}\). This is an assumption in the spirit of the model since it only disregards the somewhat artificial storage technology Y 0 and initial wealth K M and K N, consumption of which is an artefact of the two-period setup. Now

Expression (27) underestimates the effect to the extent that \({Y^* > E{\tilde C}_2}\). Combining results we have

Rights and permissions

About this article

Cite this article

Sandsmark, M., Vennemo, H. A portfolio approach to climate investments: CAPM and endogenous risk. Environ Resource Econ 37, 681–695 (2007). https://doi.org/10.1007/s10640-006-9049-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-006-9049-4