Abstract

This paper analyzes the impact of corporate taxes on the capital structure of foreign subsidiaries of multinational firms. The empirical investigation employs a large micro-level panel dataset of German multinationals covering 31 countries over a 10-year period. A special feature of this dataset is that it allows us to distinguish between internal and external debt financing. Our results confirm a positive effect of local tax rates on both types of debt. Moreover, while adverse local credit market conditions are found to reduce external borrowing, internal debt is increasing, supporting the view that the two channels of debt finance are substitutes. Our findings suggest that internal credit markets give rise to significant advantages and enhance multinationals’ opportunities to use debt as a tax shield.

Similar content being viewed by others

Notes

Under a German double tax treaty distributed profits of foreign subsidiaries are tax exempt at the corporate parent’s level. Since 2001, exemption is granted by German tax law, subject to five percent of the dividends being taxed.

In addition to the statutory tax rate we take into account up to nine control variables for the determinants of the capital structure, while the recent study by Buettner et al. (2009), for example, includes only three additional controls.

The proposition of a more pronounced tax effect under the exemption system does also hold if interest income is subject to a high tax rate as, for example, in Germany. The variation in the host country tax rate affects the incentive to use internal debt financing also if internal credit is associated with high total taxes due to the taxation of interest income.

Capital is defined as the sum of nominal capital, capital reserves, profit reserves, and total debt.

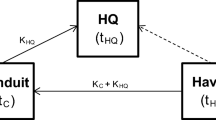

We control for the variation in German tax rates over time by means of time fixed effects because all parent companies of our sample are located in Germany. Moreover, we control, to some extent, for the unobservable heterogeneity in the financial decisions of the parent companies by means of fixed effects for each company. This also takes account of more complex company structures, such as the existence of conduit companies.

We transform the marginal tax effects into semi-elasticities of the debt ratio by dividing the marginal tax effect by the sample mean of the debt ratio.

References

Altshuler R, Grubert H (2003) Repatriation taxes, repatriation strategies and multinational financial policy. J Public Econ 87:73–107

Altshuler R, Grubert H (2006) Governments and multinational corporations in the race to the bottom. Tax Notes Int 41:459–474

Auerbach AJ (2002) Taxation and corporate financial policy. In: Auerbach AJ, Feldstein M (eds) Handbook of Public Economics, vol. 3. Elsevier, Amsterdam, pp 1251–1292

Bancel F, Mittoo UR (2004) Cross-country determinants of capital structure choice: a survey of European firms. Finance Manag 33:103–132

Buettner T, Overesch M, Schreiber U , Wamser G (2009) Taxation and capital structure choice—evidence from a panel of German multinationals. Econ Lett 105:309–311

De Angelo H, Masulis RW (1980) Optimal capital structure under corporate and personal taxation. J Finance Econ 8:3–29

Desai MA, Foley CF, Hines JR (2004) A multinational perspective on capital structure choice and internal capital markets. J Finance 59:2451–2487

Desai MA, Foley CF, Hines JR (2008) Capital structure with risky foreign investment. J Finance Econ 88:534–553

European Commission (2001) Company taxation in the internal market. COM (2001) 582 final, Luxembourg

Gopalan R, Nanda V, Seru A (2007) Affiliated firms and financial support: evidence from Indian business groups. J Finance Econ 86:759–795

Graham JR (2003) Taxes and corporate finance: a review. Rev Finance Stud 16:1075–1129

Graham JR, Harvey CR (2001) The theory and practice of corporate finance: evidence from the field. J Finance Econ 60:187–243

Graham JR, Tucker A (2006) Tax shelters and corporate debt policy. J Finance Econ 81:563–594

Grubert H (2003) The tax burden on cross-border investment: company strategies and country responses. CESifo Working Paper 964

Habib M, Zurawicki L (2002) Corruption and foreign direct investment. J Int Bus Stud 33:291–307

Harris M, Raviv A (1990) Capital structure and the informational role of debt. J Finance 45:321–349

Hines JR, Rice EM (1994) Fiscal paradise: foreign tax havens and american business. Q J Econ 109:149–182

Huizinga H, Laeven L, Nicodème G (2008) Capital structure and international debt shifting. J Finance Econ 88:80–118

Jensen M, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Finance Econ 42:159–185

Kesternich I, Schnitzer M (2010) Who is afraid of political risk? Multinational firms and their choice of capital structure. J Int Econ, 82:208–218

Kraus A, Litzenberger RH (1973) A state-preference model of optimal financial leverage. J Finance 28:911–922

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. J Finance 52:1131–1155

Lipponer A (2007) Micro database Direct Investment—MiDi. A brief guide. Bundesbank Working Paper, Frankfurt

MacKie-Mason J (1990) Do taxes affect corporate financing decisions? J Finance 45:1471–1493

Mintz J, Weichenrieder AJ (2009) The indirect side of direct investment—multinational company finance and taxation. MIT Press, 128–140

Modigliani F, Miller M (1958) The cost of capital, corporation finance, and the theory of investment. Amer Econ Rev 48:261–297

Myers SC (1977) Determinants of corporate borrowing. J Finance Econ 5:147–175

Myers SC (2001) Capital structures. J Econ Perspect 15:81–102

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Finance Econ 13:187–221

Purda LD (2008) Risk perception and the financial system. J Int Bus Stud 39:1178–1196

Rajan RG, Zingales L (1995) What do we know about capital structure? Some evidence from international data. J Finance 50:1421–1460

Ruf M (2008) How can firms choose their leverage? Tax planning for implementing tax induced debt finance. Working Paper, Mannheim University

Ruf M, Weichenrieder A (2008) The taxation of passive foreign investment—lessons from German experience, CESifo Working Paper 2624, Munich

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Buettner, T., Overesch, M., Schreiber, U. et al. Corporation taxes and the debt policy of multinational firms. Z Betriebswirtsch 81, 1325–1339 (2011). https://doi.org/10.1007/s11573-011-0520-5

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11573-011-0520-5

Keywords

- Multinational corporation

- Capital structure

- Corporate income taxation

- Internal debt

- External debt

- Firm-level data