Abstract

This paper investigates empirically the relationship between specialisation in the production of tradable output and the current account balance. According to the ‘tradability hypothesis’ that is examined, countries that specialise in highly tradable sectors tend to run current account surpluses while countries with dominant non-tradable sectors risk running current account deficits. In order to test this hypothesis empirically we develop a value-added based tradability index which captures the tradability of a country’s output. Applied to a large sample of European countries, our empirical model provides strong evidence in favour of the tradability hypothesis. The main policy implication is that the anxieties about ‘de-industrialisation’ in large parts of Europe seem justified with a view to growing external imbalances.

Similar content being viewed by others

Notes

This is because inter-temporal models of the current account are extensions of the absorption approach (see Lane and Pels 1952).

The convergence effect refers to the fact that international capital is predicted to flow from relatively capital intensive countries to countries where the effective capital-labour ratio is relatively lower. Therefore countries with lower GDP per capita will borrow internationally against future growth and will run current account deficits.

This result depends on the assumption that the inter-temporal rate of substitution is large (greater than 1).

See Appendix 4 for details.

The authors explain the lack of significance with potential multicollinearity between income per capita and the capital-output ratio which is also included in the regression.

An alternative approach to capture the tradability of goods (or sectors) is to look at tariffs or trade barriers more generally. The difficulty is that the magnitude of such trade barriers is hard to identify. While the trade costs for merchandise can be estimated with gravity models (see e.g. Anderson and van Wincoop 2004), this approach is harder to implement for services.

The tradability score can equally be calculated as the ratio between gross exports and value added and (see Bykova and Stöllinger 2016). Our preferred metric of the tradability score, however, is the one based on value added exports. See Appendix 3 for the methodological details of calculating the value added exports.

It is equally possible to calculate time-varying tradability scores. See Bykova and Stöllinger (2016).

For the list of the resulting 14 sectors and the corresponding NACE Rev. 1 and NACE Rev. 2 industry codes see Appendix 2.

One may argue that the tradability index reflects changes in the global stance to trade policy because it includes the global value added exports to vale added ratio. However, since we take the average over time of this ratio, only a long term average of the world’s stance towards ‘globalisation’ all that is included in the tradability score.

We do not derive our empirical model of the current account directly from a theoretical model. However, as mentioned in Section 2, Appendix 4 illustrated that (under plausible parameter constellations) the positive relationship between specialising in more tradable sectors (i.e. a high TI) and the current account position can be derived from a standard two-sector inter-temporal model of the current account featuring a tradable and a non-tradable sector.

The term long run here refers to the fact that a relatively long time span is covered. It is not meant in an econometric sense.

The period 1995-1997 is omitted in all specifications in order to have the same sample period across all specifications, some of which contain variables in first differences. The year 2014 is omitted in order to ensure periods of equal length.

The details of the unit root tests are found in Appendix 7.

See Appendix 8.

Exceptions are Lichtenstein, Monaco, San Marino and the Vatican. See Appendix 1 for the list of countries.

Except for those that the IMF classifies as developed countries, e.g. Czech Republic, Estonia or Slovenia. See Appendix 1.

They need to draw down on their wealth or rely on their parents respectively.

We rely on the export of crude oil (HS Code 2709). The data is obtained from UN Comtrade database accessed via the World Bank’s WITS download tool.

We follow the approach by Rodrik (2008) in estimating the expected real effective exchange rate (or relative price level) by regressing the log of the price level of consumption on the log of GDP per capita controlling for time fixed effects. The difference between the actual price level and the predicted price level is the degree to which the real exchange rate is overvalued (over_eval). A value greater than 0 indicates that a country’s real exchange rate is overvalued, values smaller than 0 indicate an undervalued real exchange rate.

Further results and a discussion of the exchange rate are found in Appendix 6.2.

In case of the Arellano-Bond estimator also the lag of the dependent variable is included as explanatory variable.

Further results for sub-groups of countries can be found in Appendix 6 and Appendix 8.

See Bykova and Stöllinger (2016) for details.

The results in Table 5 are those for the fixed effects model but they are not sensitive to the choice of the panel estimator.

A third alternative is of course to rebalance the current account by curtailing imports and hence consumption. For many EU Member States reducing consumption was the main driver behind the adjustment process after the crisis of 2008/2009.

The exposition follows Harms (2008).

The choice of Cobb-Douglas preferences further simplifies the model as the intra-temporal elasticity of substitution between the tradable and the non-tradable good is set to 1, implying that in each period the expenditure on the tradable and the non-tradable good are constant and equal to γ and 1-γ respectively. This switches of any intra-temporal substitution effects.

As is often the case in this model framework, the effect on the current account of such a structural shift towards non-tradables is theoretically ambiguous and depends on the inter-temporal and the intra-temporal elasticity of substitution as well as the initial endowments.

See Bykova and Stöllinger (2016) for details.

If the law of one price does not hold, the price of domestic tradables may also decline making them relatively cheaper compared to foreign tradables. The effect, however, will be similar: resources will be drawn into the tradables sector, in this case because of improved ‘price competitiveness’ and resulting export opportunities.

In fact also the REER ulc measure is statistically significant only if the dummy for oil exporting countries is included.

References

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Anderson JE, van Wincoop E (2004) Trade Costs. J Econ Lit 42:691–751

Barattieri A (2014) Comparative advantage, service trade, and global imbalances. J Int Econ 92(1):1–13

Berthou, A. and G. Gaulier (2013), ‘Wage dynamics and current account rebalancing in the euro area’, Quarterly selection of articles – Bulletin de la Banque de France, Banque de France, 30, Spring, pp. 71–91

Betts CM, Kehoe TJ (2006) U.S. Real Exchange Rate Fluctuations and Relative Price Fluctuations. J Monet Econ 53(334):1297–1326

Blanchard O, Giavazzi F (2002) Current Account Deficits in the Euro Area: The End of the Feldstein-Horioka Puzzle? Brook Pap Econ Act 2:147–186

Brissimis SN, Hondroyiannis G, Papazoglou C, Tsaveas TN, Vasardani AM (2010) Current account determinants and external sustainability in periods of structural change. Econ Chang Restruct 45(1):71–95

Burstein AT, Eichenbaum M, Rebelo ST (2006) The Importance of Nontradable Goods’ Price in Cyclical Real Exchange Rate Fluctuations. Japan and the World Economy 18:247–253

Bussière M, Fratzscher M, Müller G (2006) Current account dynamics in OECD and new EU member states: an intertemporal approach. J Econ Integr 21(3):593–618

Bykova, A. and R. Stöllinger (2016), ‘Tradability Index: A Comprehensive Measure for the Tradability of Output. Technical Background Paper’, Mimeo

Caballero RJ, Farhi E, Gourinchas P-O (2008) An equilibrium model of “global imbalances” and low interest rates. Am Econ Rev 98:358–393

Calderon C, Chong A, Loayza N (2002) Determinants of current account in developing countries. Contrib Macroecon 2:1–35

Ca’Zorzi, M., A. Chudik and A. Dieppe (2012), ‘Thousands of Models, One Story. Current Account Imbalances in the Global Economy’, ECB Working Paper Series, No. 1441

Coricelli, F. and A. Wörgötter (2012), ‘Structural Change and the Current Account: The Case of Germany’, OECD Economics Department Working Papers, No. 940, OECD

Cova, P., M. Pisani, N. Batini and A. Rebucci (2009), ‘Global Imbalances: the Role of Non-Tradable Total Factor Productivity in Advanced Economies’, IMF Working Paper 09/63

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59:47–76

Debelle, G. and E. Faruqee (1996), ‘What determines the current account? A cross-sectional and panel approach’, IMF Working Paper No. 58

De Gregorio J, Giovannini A, Wolf HC (1994) International Evidence on Tradables and Nontradables Inflation. Eur Econ Rev 38:1225–1244

Dollar D (1992) Outward-oriented developing economies really do grow more rapidly: Evidence from 95 LDCs, 1976–1985. Econ Dev Cult Chang 40:523–544

Drozd, L.A. and J.B. Nosal (2010), ‘The Nontradable Goods’ Real Exchange Rate Puzzle’, in: L. Reichlin and K. West (eds), NBER International Seminar on Macroeconomics 2009, pp. 227–249, University of Chicago Press

Ehmer, P. (2014), ‘The impact of diverging economic structure on current account imbalances in the euro area’, Witten/Herdecke University Working Paper, 27/2014

Engel C (1999) Accounting for U.S. Real Exchange Rate Changes. J Polit Econ 107:507–538

Fournier, J. and I. Koske (2010), ‘A Simple Model of the Relationship Between Productivity, Saving and the Current Account’, OECD Economics Department Working Papers, No. 816

Gaulier G, Vicard V (2012) Current account imbalances in the euro area: competitiveness or demand shock? Quarterly selection of articles – Bulletin de la Banque de France 27:5–26

Gehringer A (2015) New Evidence on the Determinants of Current Accounts in the EU. Empirica 42(4):769–793

Granger CWJ, Newbold P (1974) Spurious regression in econometrics. J Econ 2(2):111–120

Harms P (2008) Internationale Makroökonomik. Mohr Siebeck, Tübingen

IMF (2013), ‘IMF Multi-Country Report. German-Central European Supply Chain – Cluster Report’, IMF Country Report, No. 13/263

Im S, Pesaran H, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

Jin K (2012) Industrial Structure and Capital Flows. Am Econ Rev 102(5):2111–2146

Johnson RC, Noguera G (2012) Accounting for Intermediates: Production Sharing and Trade in Value Added. J Int Econ 86(2):224–236

Kerdrain, C., I. Koske and I. Wanner (2010), ‘The Impact of Structural Policies on Saving, Investment and Current Accounts’, OECD Economics Department Working Papers, No. 815

Lane, P.R. and B. Pels (2012), ‘Current Account Imbalances in Europe’, CEPR Discussion Papers, 8958

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61:631–652

Mendoza EG, Quadrini V, Rios-Rull J-V (2009) Financial integration, financial deepness, and global imbalances. J Polit Econ 117(3):371–416

Nedoncelle C (2016) Trade costs and Current Accounts. World Econ 39(10):1653–1672

Obstfeld M, Rogoff K (1996) The intertemporal approach to the current account. In: Grossman GM, Rogoff K (eds) Handbook of International Economics, vol 3, 1st edn. Elsevier, pp 1731–1799

Obstfeld, M. and K. Rogoff (2000), ‘The six major puzzles in international macroeconomics: is there a common cause?’, NBER Working Paper 7777

Ostry, J.D. and J.M. Reinhart (1991), ‘Private Saving and Terms of Trade Shocks: Evidence from Developing Countries’, IMF Working Paper, 91/100

Rajan R, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88:559–586

Rodrik D (2008) The real exchange rate and economic growth. Brook Pap Econ Act 2:365–412

Rodrik D (2012) Unconditional Convergence in Manufacturing. Q J Econ 128(1):165–204

Ruscher E, Wolff GB (2009) External rebalancing is not just an exporters’ story: real exchange rates, the non-tradable sector and the euro. European Economy, Economic Papers 375

Schnabl, G. and T. Wollmershäuser (2013), ‘Fiscal Divergence and Current Account Imbalances in Europe’, CESifo Working Paper Series, No. 4108

Shleifer A, Treisman D (2014) Normal Countries: The East 25 Years After Communism. Foreign Affairs 93:6

Stehrer, R. (2012), ‘Trade in Value Added and Value Added in Trade’, wiiw Working Paper, 81

Stöllinger R (2016) Structural change and global value chains in the EU. Empirica 43:801–829

Stöllinger, R., N. Foster-McGregor, M. Holzner, M. Landesmann, J. Pöschl and R. Stehrer (2013), ‘A “Manufacturing Imperative” in the EU – Europe’s Position in Global Manufacturing and the Role of Industrial Policy’, wiiw Research Reports, No. 391

Timmer MP, Dietzenbacher E, Los B, Stehrer R, de Vries GJ (2015) An Illustrated User Guide to the World Input–Output Database: the Case of Global Automotive Production. Rev Int Econ 23:575–605

Acknowledgements

Research for this paper was financed by the Jubilee Fund of Oesterreichische Nationalbank (OeNB) (Project No. 16566). I would like to thank the anonymous referees for the useful und constructive comments and suggestions. I am also grateful go to my colleagues Vladimir Gligorov, Mario Holzner, Michael Landesmann, Leon Podkaminer and Robert Stehrer for very insightful discussions. Thanks are also due to the participants at the 8th FIW Research Conference, Vienna; the Conference on Competitiveness, Capital Flows and Structural Reforms, Brno; the 18th Göttinger Workshop Internationale Wirtschaftsbeziehungen and the LEM Workshop on External imbalances, Lille for helpful comments and suggestions. Finally, I am particularly indebted to Alexandra Bykova for very valuable research assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: List of countries

Country code | Country | Country category |

|---|---|---|

AL | Albania | Emerging |

AM | Armenia | Emerging |

AT | Austria | Developed |

AZ | Azerbaijan | Emerging |

BY | Belarus | Emerging |

BE | Belgium | Developed |

BA | Bosnia and Herzegovina | Emerging |

BG | Bulgaria | Emerging |

HR | Croatia | Emerging |

CY | Cyprus | Emerging |

CZ | Czech Republic | Developed |

DK | Denmark | Developed |

EE | Estonia | Developed |

FI | Finland | Developed |

FR | France | Developed |

GE | Georgia | Emerging |

DE | Germany | Developed |

EL | Greece | Developed |

HU | Hungary | Developed |

IS | Iceland | Developed |

IE | Ireland | Developed |

IT | Italy | Developed |

KZ | Kazakhstan | Emerging |

LV | Latvia | Developed |

LT | Lithuania | Emerging |

LU | Luxembourg | Developed |

MK | Macedonia | Emerging |

MT | Malta | Emerging |

MD | Moldova | Emerging |

ME | Montenegro | Emerging |

NL | Netherlands | Developed |

NO | Norway | Developed |

PL | Poland | Emerging |

PT | Portugal | Developed |

RO | Romania | Emerging |

RU | Russia | Emerging |

RS | Serbia | Emerging |

SK | Slovakia | Developed |

SI | Slovenia | Developed |

ES | Spain | Developed |

SE | Sweden | Developed |

CH | Switzerland | Developed |

TR | Turkey | Emerging |

UA | Ukraine | Emerging |

UK | United Kingdom | Developed |

XK | Kosovo | Emerging |

Appendix 2: List of sectors for the calculation of the tradability index

Number | Sector | NACE Rev. 1 | NACE Rev. 2 |

|---|---|---|---|

1 | Agriculture, hunting and forestry + Fishing | A + B | A |

2 | Mining and quarrying | C | B |

3 | Manufacturing | D | C |

4 | Electricity, gas and water supply | E | D + E |

5 | Construction | F | F |

6 | Wholesale, retail trade, repair of motor vehicles etc. | G | G |

7 | Hotels and restaurants | H | I |

8 | Transport, storage + Communication | I | H + J |

9 | Financial intermediation | J | K |

10 | Real estate, renting and business activities | K | L + M + N |

11 | Public administration, defence, compuls.soc.security | L | O |

12 | Education | M | P |

13 | Health and social work | N | Q |

14 | Other community, social and personal services + Private households with employed persons | O + P | R + S + T |

Appendix 3: Methodology for calculating value added exports

Deriving the tradability score requires the calculation of the value added exports (VAX) at the industry-country level. This appendix illustrates the basic input-output methodology to calculate the VAX, including a 3-country, 2-sector example.

Following the trade in value added concept in Johnson and Noguera (2012) and the expositions in Stehrer (2012), three components are required to calculate the value added exports. For any reporting country r, these components are the value added requirements per unit of gross output, vr; the Leontief inverse of the global input-output matrix, L; and the final demand vector, fJ where J indicates that the vector includes demand from every country j ∈J. Both vectors as well as the Leontief inverse have an industry dimension i.

Country r’s value added coefficients are defined as \( {v}^r=\frac{{value\ added}_r}{{gross\ output}_r} \). The value added coefficients are arranged in a diagonal matrix of dimension 1435 × 1 (41 countries × 35 industries). This matrix contains the value added coefficients of country r for all industries along the diagonals. The remaining entries of the matrix are zero because the interest here is with the value added created in country r.

The second element is the Leontief inverse of the global input-output matrix, L = (I − A)−1 where A denotes the coefficient matrix. In the World Input-Output Database (WIOD) the coefficient matrix (and hence the Leontief matrix) is of dimension 1435 × 1435 which contains the technological input coefficients of country r in the diagonal elements and the technological input coefficients of country r’s imports (from a column perspective) and exports (from a row perspective) in the off-diagonal elements.

The final building block is the global final demand vector. This vector is also industry-specific and is of dimension 1435 × 1. Importantly, the final demand comes from different countries (i.e. the origin of the final demand). As usual, each of the rows is associated with one source country of the goods and services that are finally demand. Therefore, the full final demand vector, fJ, in the 3-country, 2-sector case, with m (for manufacturing) and s (for services) indicating the sector (or industry), has the following form:

where the subscript J indicates that the vector comprises the consumption of all countries j ∈ J. The typical element of this vector contains the final demand from all possible countries. For example, the element \( {f}_m^{r,3} \) captures the value of final goods and services that country 3 demands from the manufacturing sector in country r. Since the idea of value added exports is that they comprise only value added that is created in one country but absorbed in another, the final demand from country r itself needs to be eliminated for the calculation of country r’s VAX. An adjusted final demand vector, fj ≠ r, is used in which country r’s final demand (i.e. the first column in the above matrix) is set to zero. Country r’s value added exports can then be calculated as

where VAXr, ∗ are the sector-specific value added exports of country r to all partner countries.

To illustrate this, the detailed matrices in the 3 country, 2-sector case, where country r is still the model country are shown. Equation (3) then has the following form:

The coefficients in the Leontief matrix represent the total direct and indirect input requirements of any country in order to produce one dollar worth of output for final demand. For example, the coefficient \( {l}_{m,s}^{r,r} \) indicates the input requirement of country r’s services sector from country r’s manufacturing sector for producing one unit of output. Likewise, the coefficient \( {l}_{m,m}^{r,3} \) indicates country r’s input requirement in the manufacturing sector supplied by country 3’s manufacturing sector.

The resulting elements in this example, \( {VAX}_{m,\ast}^{r,\ast } \) and \( {VAX}_{s,\ast}^{r,\ast } \), are the total value added exports of country r that originate from the manufacturing and services sector respectively, to all other sectors of all partner countries.

The VAX are not only calculated for country r but for all 40 countries plus the rest of the world.

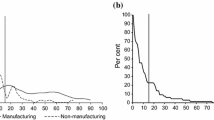

The final step needed to arrive at the global industry-level VAX is to sum up the VAX of all countries for each individual sector i. Dividing the global industry-specific VAX by the corresponding industry-specific value added yields the tradability score by sector. In that process, also the more detailed industry structure available in the WIOD database (35 industries) is aggregated to the 14 broad sectors on which the tradability index is based.

Appendix 4: The effects of a structural shock in an inter-temporal current account model

This appendix provides simulation-based insights into the effects of a structural shock towards non-tradable goods in a very simple two-period inter-temporal model of the current account that features a tradable and a non-tradable sector (Obstfeld and Rogoff 1996). As will be shown, the tradability hypothesis that is tested empirically can be derived from such as model under reasonable parameter settings. The first part of this Appendix presents the basic model, while the second section describes the actual outcomes of the structural shock of interest.

1.1 The inter-temporal current account model

Consumption

There are only two periods. The representative consumer derives her utility from consumption in periods t = 1 and t = 2. Preferences are characterised by a constant inter-temporal elasticity of substitution, \( \frac{1}{\sigma } \), resulting in a utility function with constant relative risk aversion of the formFootnote 28

where Ct is the instantaneous consumption in period t and β is the discount factor indicating the consumer’s patience with regard to postponing consumption. In each period the consumer splits consumption between the consumption of the tradable good \( \left({C}_t^T\right) \)and the consumption of the non-tradable good \( \left({C}_t^N\right) \) assigning a constant fraction to each of the two goods. This gives rise to Cobb-Douglas style preferences

where γ is the consumption share of the tradable good.Footnote 29

Cost minimisation yields the demand functions for the two types of goods

Given that Pt is the numeraire, the price of the non-tradable good, \( {P}_t^N \), is determined by the relative consumption of the two goods.

Since the expenditure share of the two goods are fixed, the price index takes the simple form

Once the intra-temporal choices are made, the consumer chooses the optimal consumption path over time. For the postponement of consumption until period 2 of any of her income, the consumer is compensated with the interest rate r which is assumed to be determined on international capital markets and therefore exogenous. The consumer maximises lifetime utility in (4) under the intertemporal budget constraint

which simply states that the sum of consumption in periods 1 and 2 must equal the sum of the (exogenous) output in the two periods. This maximisation problem leads to the usual Euler equation

with σ > 0.

The more patient the consumer is, i.e. the higher β, the more is she prepared to postpone consumption until period 2. Likewise, the higher the interest rate, the greater is the resulting income effect and the more consumption is shifted to period 2. Finally, a lower relative inter-temporal price level, \( \frac{P_1}{P_2} \), (i.e. a decline in the price index over time) will induce the consumer to shift consumption towards period 2.

1.1.1 The current account

The current account in period 1 is simply the difference between the consumer’s endowments with tradable goods and the consumption of tradable goods:

Taking into account that in each period the consumption of the non-tradable good equals the endowment, the intertemporal budget constraint in (12) simplifies to

Combining the equation for the current account with the demand function for the tradable good (6), the Euler eq. (10) and the simplified version of the intertemporal budget constraint (12) yields the following expression for the current account equation in period 1:

The demand function for the non-tradable good (7), together with the price index (8) and the Euler eq. (10) yields an expression for the relative demand for the non-tradable good in the two periods which depends on the relative inter-temporal prices and the intertemporal elasticity of substitution (IES). Since in the case of the non-tradable good consumption equals endowment in each period one obtains:

This equation describes the development of the price index in relation to the development of the supply of the non-tradable good over time. Since 0 < γ < 1 and σ > 0, an increase in the supply of the non-tradable good over time, i.e. an increase in\( {Y}_2^N \), leads to a decrease in the price index in period 2 (P2) and consequently an increase in the relative price index \( \frac{P_1}{P_2} \).

Inserting (14) into (13) yields the formulation of the current account equation as stated in the main text:

This expression states the current account position as a function of the endowments in the tradable and the non-tradable good, the inter-temporal elasticity of substitution, the consumption expenditure share of the tradable-good, γ, (which is assumed to be constant), the interest rate and the discount factor (β). This equation is used to examine the effects of an endowment-neutral structural shock on the current account and the tradability index.

1.2 The effects of a structural shocks towards non-tradables on the current account balance

As mentioned in the main text, the tradability hypothesis is compatible with the inter-temporal current account model’s predictions for the current account position resulting from a non-tradables shock. More precisely, the non-tradables shock is an endowment-neutral structural shock in period 2 that consists of an increase in the economy’s endowment with the non-tradable good YNand a simultaneous decrease in its endowment with the tradable good YTby the same amount. This allows highlighting the impact of the structural effect by switching off the wealth effect which would arise if only YTor YN were to change. This endowment-neutral structural shock corresponds to a decline in the tradability index (TI) in the empirical analysis.

The main adjustment mechanism in the inter-temporal endowment economy is the consumption decisions made by the welfare maximising representative consumer.. The effect of the adjustments of the consumption plans (induced by the structural shock) on the current account works via two channels. The first channel is that the consumer postpones consumption into period 2 because she wants to consume the tradable and the non-tradable good in fixed proportions, governed by the expenditure share of the tradable good, γ (structural consumption adjustment effect). The second channel is the decline in the price index over time which means that the consumption-based interest rate increases (income effect). Hence, under reasonable parameter settings, the structural shock that is of interest here will cause a deterioration of the current account.Footnote 30

We rely on simulations to show the relationship between the tradability of output and the current account for plausible values of the expenditure shares γ and 1 − γ, the initial endowments \( {Y}_1^T \) and \( {Y}_2^N \) and the inter-temporal elasticity of substitution σ.

Let the initial situation be characterised by a balanced current account with the parameterisation shown in Table 6.

Table 7 shows the effect on the tradability index, \( \raisebox{1ex}{${Y}_t^T\cdotp {P}_t^T$}\!\left/ \!\raisebox{-1ex}{${Y}_t\cdotp {P}_t$}\right. \), and the current account of a structural shock in period 2 consisting of a decline in \( {Y}_2^T \) by 20 unit and an increase in \( {Y}_2^N \) of equal size. In the initial situation the current account is balanced in both periods. Given that the expenditure share on the tradables is 0.2 and the tradable good’s share in the economy’s total endowment is also 0.2, the prices of the tradable and the non-tradable goods are both equal to 1 in both periods and the price index is equal to 1.65 in both periods.

The consequence of the structural shock in period 2 is a current account surplus in period 1 and a corresponding deficit in period 2. The surplus in period 1 is explained by two effects.

First, there is a structural consumption adjustment effect. This structural adjustment effect stems from the fact that the consumer maximises utility when she consumes the tradable and the non-tradable good exactly in the proportions dictated by the expenditure share. In the above example this is a ratio of 1 to 4. The structural shock that hits in period 2 reduces the tradables to non-tradables ratio in terms of endowments to a much lower level. This creates an incentive to shift some of the tradable good consumption from period 1 to period 2. The extra utility gained in period 2 (ΔC2) from this shift exceeds the loss in aggregate consumption in period 1 (ΔC1).

Second, there is an income effect which stems from the fact that the price index is declining over time because the endowment of the non-tradable good increases in period 2. The declining price index represents an increase in the consumption-based interest rate and is therefore an incentive for the consumer to postpone consumption until period 2. This second effect also contributes to the current account surplus in the first period. Due to the terminal condition, the resulting current account position in period 2 is a corresponding deficit.

The magnitude of both effects is determined by the extent to which consumption is postponed which in turn depends on the IES. If the IES is large, relatively more consumption will be shifted into period 2 as the consumer is relatively more prepared to accept fluctuations in the consumption path over time. Note that these results are not due to a wealth effect, which is neutralised by simultaneously increasing the endowment of the non-tradable good and reducing the endowment with the tradable good by the same amount (i.e. \( \mathit{\Delta }{Y}_2^N=-\mathit{\Delta }{Y}_2^T \) with \( \mathit{\Delta }{Y}_2^N>0 \)).

Hence, with the parameter constellation as in Table 6 the result of the structural shock towards non-tradables at the time when that shock materialises, i.e. period 2, is that the TI declines as does the current account balance. It is also clear that in period 2, a country that suffers from such a structural shock will have a lower TI and a worse current account position than a country that does not experience such a shock (given that both countries start with the same initial conditions). Figure 9 illustrates the evolution of the current account balance, the tradability index and the price index for various values of the inter-temporal elasticity of substitution (IES).

Current account, TI and relative prices after the structural shock (\( {Y}_1^T=100 \); \( {Y}_1^N=400 \)). Note: Parameters as in Table 6 except for the inter-temporal elasticity of substitution (IES); structural shock in t2: \( \Delta {Y}_1^T=-20;\Delta {Y}_1^N=+20 \)

Appendix 5: Additional regression results

1.1 Results by country groups

Estimating the cross-section model in eq. (1) for individual country groups entails the problem that the number of observations is getting very small. Nevertheless we perform this analysis as one of several robustness checks.

The model is re-estimated separately for developed and emerging European countries as well as the EU Member States, euro area members and the Central, Eastern and South Eastern European (CESEE) region. We further report results for the entire sample excluding Azerbaijan and Montenegro which are outliers regarding the current account balance as well as the entire sample excluding Ireland, Lithuania and Malta for which the fit between the country-level tradability scores and the global scores is somewhat weaker.Footnote 31

As shown in Table 8 the results – and in particular the result regarding the tradability index – hold throughout all sub-samples. As expected the tradability of output matters more for the external balance in the case of emerging countries than for developed countries, though this results is also influenced by the oil exporters within this group. Potential explanations for this finding are that the components of the current account which are not (or only indirectly) linked to the tradability of output, such as payments of factor incomes, play a larger role in developed countries and that industrial countries only require a smaller industrial base which is increasingly interlinked with services and performs an important carrier function (see Stöllinger et al. 2013) by absorbing a large amount of services which are exported only indirectly via manufactures. An interesting result is also that the government balance turns out to be positive and highly significant for the industrialised European countries and the EU Member States but not the emerging markets. Hence, for the former, the twin deficit hypothesis seems to have some relevance. Some of the other control variables which are found to be statistically significant in the specification using the full sample are also very robust across the various sub-samples such as the net foreign asset position and the relative GDP per capita. For others no statistically significant effects can be established though it is hard to tell whether this is due to the small number of observations or the particularities of the respective country group.

Finally specification (7) and specification (8) show that the cross-section results are not driven by outliers.

Table 9 provides the same robustness check for the panel regression model. Also in this case the tradability index is reported to have a positive and statistically significant coefficient for each country group. The relative size of the coefficients of the TI across country groups indicates that the tradability of output a country produces matters more for emerging Europe than for the developed European economies, thereby confirming the outcome of the cross-section regressions.

There are also a few differences across the country groups with regard to some of the control variables, notable the government balance where for the developed countries the twin deficit hypothesis is confirmed whereas for the emerging European countries the coefficient of the government balance has a negative sign.

1.2 The role of the real exchange rate

Some of the specifications in the main text included the real effective exchange rate based on unit labour costs (REER_ulc)._Here the complex issue of the real exchange rate is discussed in some more detail and additional regression results using alternative measures of the exchange rate are reported.

Relative prices (respectively changes thereof), that is the bilateral real exchange rate (respectively changes thereof) influence the current account positions via exports and imports. As long as the Marshall-Learner condition is fulfilled, an increase in the relative price level worsens the current account balance by hampering exports and facilitating imports.

In our context, the issue is complicated by the fact that apart from this direct channel, relative prices may affect the current account also indirectly via its impact on countries’ specialisation patterns. Let’s assume a decline in the domestic price level (real exchange rate) caused, for example, by some change in the underlying labour market institutions such as an agreement between employers’ associations and the trade unions on wage moderation. The wage moderation policy tends to depress the overall price level relative to the trading partners (real depreciation). This is because wage moderation implies that wages are progressing at a slower pace than productivity resulting in a fall of production costs (i.e. the wage mark-up over marginal labour productivity declines). A first consequence will be that the price of non-tradables declines. The price of tradables remains constant due to the law of one price.Footnote 32 This will cause a shift of domestic resources from the non-tradable sector to the tradable sector because of increased profit opportunities in the latter until the relative price between non-tradables and tradables has adjusted accordingly. Resources will be drawn into the tradable sector and the domestic price level P (defined as PN/PT) will adjust to equalise the marginal revenue product in the two sectors. So the key results will be an expansion of the tradable sector and a depreciation of the real exchange change. Since wage moderation will either reduce income or keep it unchanged, there will be no growth effect as in the case of a (positive) productivity shock that will cause households to shift consumption forward. For this reason, wage moderation should also lead to an improvement of the current account position (see e.g. Berthou and Gaulier 2013).

Wage moderation is one scenario in which changes in the real exchange rate will affect the composition of output (and hence our tradability index). However, the causality may go in both directions. Given that, depending on the ultimate (exogenous) shock, changes in the production structure drive the development of domestic prices and the real exchange rate or vice versa, the simplest way to integrate exchange rate developments into the empirical analysis is to include it as an additional explanatory variable into the regression model. The expectation is that a higher relative price level, respectively an appreciation of the real exchange rate, worsens the current account. The main interest, however, is not with the sign of the real exchange rate (or changes thereof) but how its inclusion affects the coefficient of the tradability index. More precisely, if the specialisation patterns and resulting production structures were predominantly the result of relative prices, the real exchange rate should pick up this effect rendering the TI variable superfluous. In other words the inclusion of a measure for the real exchange rate acts as a robustness check ruling out the possibility that the tradability index only captures changes in relative prices.

The above reasoning presumed that the price of one law holds. If the law of one price were to hold for tradable goods, changes in the real exchange rate would be entirely due to the evolution of the price of non-tradables. While a convenient assumption, the law of one price is not supported by empirical research. By decomposing real exchange rate movements, Engel (1999) and Betts and Kehoe (2006) show for the US that these movements are predominantly explained by deviations of relative prices of tradable goods and not change in the relative price of non-tradables. Drozd and Nosal (2009) confirm this finding for a sample of 21 countries assigning on average only a third of real exchange rate movements to the non-tradable sector. The results in Burstein et al. (2006) suggest a somewhat greater role for the price of non-tradables in a sample of OECD countries, giving both sectors approximately equal importance for determining real exchange rate movements. Drozd and Nosal (2010) also find a greater role for price developments in the non-tradable sector in European countries than in other countries which they assign to the fact that nominal exchange rates are fixed in the euro area. A similar argument for this phenomenon is found in Ruscher and Wolff (2009). Irrespective of the exact contribution of international price differences in tradables on the one hand and the non-tradable sector on the other hand, for the empirical analysis it is useful to keep in mind that fluctuations in the exchange rate may be caused by both.

To include an overall measure for the real exchange rate we use the price level of consumption from the Penn World Tables (version 8.1) as well as the real effective exchange rate based on unit labour costs which is used in the main text. The latter indicator is also a common measure for countries’ international competitiveness. If prices were equal to labour productivity, the unit labour cost based real effective exchange rate would equal the nominal exchange rate. A third indicator used is the measure of undervaluation or overvaluation of the exchange rate (over_eval) suggested by Dollar (1992). The measure is based on the price level of consumption and exploits the empirical regularity that the price level is generally higher in countries with higher per capita income. We follow the approach by Rodrik (2008) in estimating the expected real effective exchange rate (or relative price level) by regressing the log of the price level of consumption on the log of GDP per capita controlling for time fixed effects. The difference between the actual price level and the predicted price level is the degree to which the real exchange rate is overvalued (over_eval). A value greater than 0 indicates that a country’s real exchange rate is overvalued, values smaller than 0 indicate an undervalued real exchange rate.

Given the link between a higher real effective exchange rate and the current account described above, a negative sign for the coefficient of the exchange rate measure is to be expected.

We test for the impact of these three exchange rate measures (see Table 10).

The major insight from these specifications using alternative real exchange rate measures is that the magnitude of the coefficient of the tradability index remains largely unaffected by the inclusion of the real exchange rate measures. Among the exchange rate measures, only the changes in the unit labour cost based REER (see specification 4) turn out to be statistically significant, though only marginally.Footnote 33 As expected the sign is negative implying that a real appreciation makes it more difficult to not run a current account deficit. Our conclusion from this is it is very unlikely that the positive relationship between the TI and the current account is due to a spurious correlation driven by changes in relative prices.

1.3 Tradability of output and the trade balance

As another robustness check we re-run the regression model in eq. (1), replacing the current account balance with the trade balance as the dependent variable. The expectation is that the relationship between the TI and the trade balance is even stronger than between the TI. This is because the tradability of output should affects the current account and the trade account in the same manner, only that the former also contains other elements (notably net income and transfers) which may dilute the relationship. The results in Table 11 fully confirm this expectation.

These results are informative as they indicate that the income balance and the transfer balance are highly relevant elements for the position of the current account. At the same, the tradability of output which affect the current account via the trade balance still seems to be a key determinant for the position of the current account and not only to the trade balance. In other words, net income received and net transfers, on average, are still insufficient to compensate for an increasing specialisation in the production of non-tradable output.

As shown in Table 12, the tradability hypothesis is equally confirmed when applied to the trade in the panel regression model.

Appendix 6: Unit root tests

This appendix provides additional information on the unit root tests.

While the time series dimension of our panel data covers only 20 years, we check all the variables for the presence of a unit root. This is advisable since in case of a unit root present in any (or several) of the time series, the regression results may be spurious (see Granger and Newbold 1974). Therefore we perform standard panel unit root tests opting for the methods suggested by Im et al. (2003) and the Fisher-type tests (see Maddala and Wu 1999). Both the Im-Pesaran-Shin (IPS) test and the Fisher-type tests have as the null-hypothesis that all panels contain a unit root against the alternative that some panels are stationary. For the IPS test we let the lag structure be determined by the Akaike information criterion (AIC), for the Fisher-type tests we include a one-period lags, except for the government balance in the test with time trend where two lags are included (given that the number of lags suggested by the AIC in the IPS test is closer to two).

We rely mainly on the IPS tests and use the Fisher tests as a robustness check only. According to the IPS tests for the main series, i.e. the current account series and the TI series, the null-hypothesis can be rejected, although for the TI in the test without a time trend only at the 10% level (see Table 13). Since the Fisher-type tests in this case clearly reject the null-hypothesis and the TI series for most countries do seem to have a time trend we consider the unit root tests as satisfied.

With regard to the control variables the tests signal the presence of a unit root in the case of the net foreign assets, the dependency ratio and the domestic credit. For this reason we let these variables enter the panel regression model in first differences. The differenced variables clearly pass the unit root tests (see Table 14).

Appendix 7: Panel regression results in first differences

In Table 15 the results from the regression model in eq. (2) using first differences of all variables are presented. This should avoid the possibility that results may be invalid due to the data (or parts thereof) being integrated of order one. Certainly, the differenced version of the panel model should only be given a short term interpretation. We use this specification mainly to show that the confirmation of the tradability hypothesis in the data is not spurious.

Regarding the choice of the appropriate estimator, a Hausman test rejects the appropriateness of the random effects model. The subsequent F-test suggests that the inclusion of the country fixed effects is not necessary. Hence, in contrast to the panel model in levels, when estimating the model in first differences, the pooled model in specification 1 (which in this case includes time fixed effects) can be considered as the appropriate model. However, also here the result is not sensitive to the choice of the panel estimator.

Rights and permissions

About this article

Cite this article

Stöllinger, R. Tradability of output and the current account in Europe. Int Econ Econ Policy 17, 167–218 (2020). https://doi.org/10.1007/s10368-019-00449-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-019-00449-y