5.2.1. Evidence from the Case: Resources and Outsourcing Types

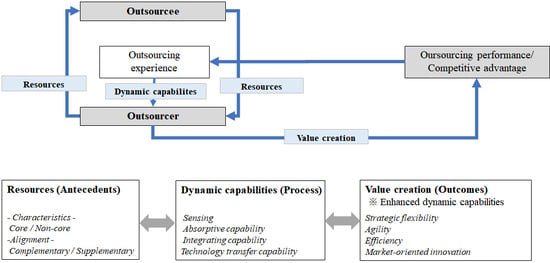

As a result of the content analysis for the four leading, established firms (i.e., outsourcers) in the medical device industry, we go into detail of the research framework in

Figure 5. Firstly, we found four distinctive types of outsourcing events according to the characteristics of outsourced resources, i.e., core or non-core, and their alignment with resources owned by the outsourcer, i.e., supplementary or complementary. In the outsourcing events of type I and II, the firms outsourced core resources for the purpose of supplementing or complementing their current capabilities, respectively. While in type I outsourcing, mutually complementary resources of the outsourcer and the outsourcee were combined, and expanded the existing resource bases, in type II outsourcing, the outsourcer acquired resources that could reinforce its capabilities by supplementing its resource base. In type III, the firm outsourced its non-core activities, such as production and payroll service, which as a result, supplemented their core activities. In type IV, the outsourcer transferred a core part of its resource base to the outsourcing partner, for the purpose of taking advantage of the outsourcee’s local network and expanding the marketplace.

Figure 6 indicates the four types of outsourcing, along with the characteristics and alignment of the outsourcing resources.

Several items of evidence from the case according to each outsourcing type are described as follows. The

Appendix A briefly summarizes the main outsourcing events with key phrases from the articles, media sources and classified outsourcing types.

• Type I: Outsourcer (Core resource) + Outsourcee (Core resource)

Collaboration in technology with a variety of partners has been the most common type of outsourcing in the technology-intensive firms engaged in the medical device business. The outsourcer develops diverse innovative products that are well adapted to the changing market, by integrating appropriate external technologies with internal competence, thereby creating synergy. In this type of outsourcing, core resources of both the outsourcer and outsourcee, which are dissimilar and mutually complementary, are involved in outsourcing activities. Many events summarized in the

Appendix A (ID: M1–M6, P1–P10, G1–G8, J1–J4) support that the four established firms have combined their strengths with appropriate partners to expand their capabilities and diversify business models, several items of the evidence of which are described below.

Medtronic has integrated its sophisticated medical technologies with another core technologies such as Fitbit’s automatic activity tracking technology, which provides insights into how exercise affects glucose levels for more effective diabetes care management (ID: M1), and IBM’s artificial intelligence unit, which enabled the diabetes devices of Medtronic to predict whether a diabetic person will have low glucose (ID: M2). Medtronic also took advantage of its market-leadership in diabetes management in collaboration with Qualcomm Life’s expertise to create more affordable, easier-to-use Continuous Glucose Monitoring (CGM) systems that can provide near real-time and retrospective glucose data (ID: M4). Medtronic’s range of future solutions, jointly developed with Samsung Electronics, could improve the way people with diabetes live, by remotely viewing diabetes data and ultimately integrating mobile devices into diabetes management systems (ID: M5).

In the case of Philips, a partnership with Amazon connected millions of devices to the Internet of Things (IoT) using Amazon Web Services (AWS) (ID: P1). Philips also made a strategic alliance with Salesforce.com, leveraging Philips’ leadership in medical technology and Salesforce.com’s leading position in enterprise cloud computing by delivering a cloud-based healthcare platform (ID: P3). For the purpose of a long-term collaboration with partners, Philips secured certified compatibility between its products and the outsourced systems (ID: P8).

GE Healthcare also established its cloud system that integrates powerful IT solutions of large-sized system integrators and leading-edge independent software vendors across a range of care areas (ID: G5, G6).

J & J integrated its core capabilities with experts in 3D-printing technology in order to develop 3D printed products in the areas of orthopedics, eye health, and consumer health. For example, 3D printed surgical devices increase the predictability and efficiency of surgery, and pharmaceutical researchers can recognize how the drug compounds will react in a real human body by measuring the toxicity levels of compounds on 3D printed kidney cells or liver cells (ID: J1–J3).

• Type II: Outsourcer (Core resource) → Outsourcee (Core resource)

When the firm plans to catch up with cutting edge technology of the industry to fulfill customer needs promptly, it particularly needs external partners with advanced technologies to fill the technology gap. In this type of outsourcing, the outsourcer acquires the necessary external resources and sometimes the relevant organization or company. The firm would also make a cross license agreement with the technology provider to use the necessary intellectual property, in the case that mutual interest is met. The outsourced resources, which are core resources of the outsourcee in this type, are supplementary to resources owned by the outsourcer, thereby enhancing the core competence of the outsourcer. Part of the events in

Appendix A (ID: M7, P11–P14, G9–G11) correspond to this type.

Philips could strengthen its innovation pipeline of catheter-based therapy devices by acquiring CardioProlific, because CardioProlific’s technologies are supplementary to Philips’ portfolio of image-guided therapy devices. The acquisition of CardioProlific underpins Philips’ strategy to develop new solutions for clinicians to guide and confirm the adequate therapy for cardiac and peripheral vascular disease (ID: P11). In addition, Philips has signed an agreement to acquire EPD Solutions, an innovator in image-guided procedures for heart rhythm disorders, which supplements Philips’ portfolio of interventional imaging systems, smart catheters, planning and navigation software, and services. As a result of the acquisition, Philips could introduce new solutions in the fast-growing EUR 2+ billion market for the image-guided treatment of cardiac arrhythmias (ID: P12). Philips also acquired Remote Diagnostic Technologies (RDT), a leading innovator of advanced solutions for the pre-hospital market, providing cardiac therapy and data management, for the purpose of enhancing Philips’ Therapeutic Care business and strengthening its leading position in the EUR 1.4 billion resuscitation and emergency care market (ID: P14).

In the case of GE Healthcare, the firm reinforced its capability to provide a variety of ultrasound disinfection solutions to customers by outsourcing CS Medical’s products, which provides healthcare professionals the tools to properly reprocess the delicate ultrasound probe, thereby minimizing healthcare-acquired infections (ID: G9). GE Healthcare also outsourced SonoSim’s solution that offers training from the basics to hands-on simulations of real-world, pathologic cases from actual patients. GE Healthcare invested $13 million to help build a modernized healthcare system in Kenya by building the GE Healthcare Skills and Training Institute, for the purpose of training healthcare professionals in the use of the up-to-date technology (ID: G11).

• Type III: Outsourcer (Core resource) ← Outsourcee (Non-core resource)

The management may decide to outsource if the sum of production and transaction cost is less than the internal production cost. This strategy, where the firm outsources a non-core part of its operation, for example, offshoring to a low-wage country, is the most common strategy used in the traditional manufacturing firms for the purpose of minimizing overall cost. Although not many outsourcing events of medical device firms belong to this type, several events in

Appendix A (ID: M8, G12, J5, J6) could be classified to this type.

For the purpose of R & D efficiency and cost reduction, Medtronic outsourced transactional and repetitive jobs that do not require high-level knowledge of Medtronic. For example, the firm hired the well-known outsourcing and IT services firm Cognizant, whose department provided customer service and phone-answering functions for Medtronic (ID: M8).

GE Healthcare also outsourced the non-core process of training doctors and nurses on all the machines General Electric manufactures, from MRI machines to ultrasound equipment. Such operation is typically cumbersome and expensive, involving flying doctors to training sites, or else sending experts out to hospitals. However, a new partnership with InTouch Health helped to bring remote education, training and technical support for a bunch of GE imaging products (ID: G12)

J & J has signed an exclusive original equipment manufacturer (OEM) agreement with Nova Biomedical to provide its point-of-care blood glucose testing systems to hospital customers in China. By outsourcing non-core process to the emerging market, J & J could serve the changing needs of a fast-growing market with increased efficiency (ID: J5). Besides, J&J could save time in reconciling payroll issues, and focus more on its core activities, by partnering with PayrollServe, a specialized firm in payroll matters (ID: J6).

• Type IV: Outsourcer (Core resource) + Outsourcee (Non-core resource)

Another type of outsourcing classified from the case analysis occurs when the outsourcer plans to expand the business by exploring new markets. In this type, the outsourcer transfers resources to the outsourcee that typically belongs to a developing country with a relatively low level of industrial technology. For example, the outsourcer grants the local partner a license to develop the products, or shares the relevant know-how with the firm, whereas the local partner can acquire core technology from the outsourcer, thereby enhancing its own competence. Such outsourcing can be supported by the local government, because the collaboration may bring a positive ripple effect to the entire national industry. Even though the outsourcer does not receive an immediate return from the transaction, it could gain access to a new niche market, and from a long-term perspective, take the initiative in the industrial ecology by securing more and more distribution networks. Part of the events in

Appendix A (ID: M9, P15–P18) exemplify this type of outsourcing.

As an emerging market strategy, Philips has established a unique cooperation format with Russian firms of leading industrial networks in the local market. The firm partnered with Electron, a leading Russian medical equipment manufacturer, supporting the modernization of the healthcare system at technology and even strategy levels, by bringing in Philips’ global expertise to serve the needs of the Russian healthcare system (ID: P15). Philips also cooperated with MEDSI, a leading provider of patient-centered quality care in Russia, taking advantage of the healthcare facilities of MEDSI. This new partnership provides MEDSI with guaranteed affordable access to the Philips’ latest healthcare equipment, technology, and international expertise in hospital management, beyond the traditional supply of equipment (ID: P16). In addition, with the signing of a ten-year strategic partnership agreement with the Expert Group of Companies, Russia’s leading networks of healthcare centers and clinics, Philips provided its clinical expertise, consulting services, and technology planning for multidisciplinary medical centers (ID: P17).

In the case of Medtronic, the firm has developed an innovative partnership with the National Institute of Hospital Administration, an influential think tank under China’s National Health, to carry out research projects focusing on building an integrated care system for patients with diabetes. This partnership shows an effort to collaborate with an important organization to access data necessary to understand the clinical and economic value of therapies, and how they can best be utilized in a patient population. In this joint endeavor, Medtronic shared with the Chinese government the extensive experience it has accumulated through dealing with a similar mechanism in other countries around the world (ID: M9).

5.2.2. Dynamic Capabilities and Value Creation

The case study results also explain details of other elements of the proposed research framework: dynamic capabilities and value creation. The four leading, established firms showed different dynamic capabilities in the events of different outsourcing types. In all types of outsourcing, the sensing capability of understanding market demands and continuously exploring an appropriate partner with superior or cheaper resources play a key role in the successful outsourcing process. For example, Omar Ishrak, chief executive officer of Medtronic, recognized market needs and realized where to focus, by saying, “Diabetes is unfortunately rising in prevalence around the world, driving up system costs and, …we believe there is tremendous opportunity to better align care across the diabetes care continuum through new technologies and patient care management strategies” (ID: M6).

Specifically, the outsourcer that plans type I outsourcing requires integrating capability to combine different kinds of resources based on mutual trust and cooperation among the outsourcing partners [

10,

54]. When GE Healthcare collaborated with Zenith Technologies, it announced that the two companies integrated process control systems, and other supporting technologies with GE Healthcare’s start-to-finish technologies for the biopharmaceutical manufacturing industry (ID: G4). As a result, the outsourcer could create market-oriented innovation. “Using the Arterys System together with cloud computation, the diagnoses can be made in a non-invasive MR imaging procedure that is quick, accessible and easy for both the patient and the radiologist,” said Fabien Beckers, Arterys CEO, in a statement in 2016 (ID: G1). Also, the partnership offered more choices to customers by diversifying the solutions. GE Healthcare announced that it will bring IT solutions for clinicians across a range of care areas, by collaborating with two large systems integrators and seven leading-edge software vendors (ID: G5). In some cases, type I outsourcing brings benefits of lower total costs, as announced by Jim Davis, GE Healthcare’s management, in 2011. “Research in this area aims to bring benefits of lower total costs,…and makes this an attractive opportunity for collaboration” (ID: G8).

In type II outsourcing, the outsourcer needs absorptive capability to acquire, learn, and share external knowledge within the organization. Through the outsourcer’s absorptive capability, the absorbed external resources can form a knowledge evolution cycle of promoting the outsourcer’s core competence and exploring more advanced technologies. In particular, established firms need a culture of openness to successfully acquire external knowledge, while overcoming organizational inertia, and accepting unfamiliar changes. As a result of this outsourcing, the outsourcer can create diverse market-oriented value by reinforcing its resource base with outsourced up-to-date technologies in a shorter period of time than developing entire technologies internally. Strategic flexibility can be increased by diversifying products from utilizing multiple outsourcing partners, and thereby spreading risk in a volatile environment. Several announcements from the management show evidence of the value created by the outsourcing, such as the following statements: “…this agreement reinforces GE’s ongoing pledge to provide a variety of ultrasound disinfection solutions to help our customers improve patient outcomes” (ID: G9), “Medtronic acquired the OsteoCool technology and…the OsteoCool System expands our Pain Therapies portfolio” (ID: M7).

In type III outsourcing, a sensing capability of the decision maker to continuously relocate resources wherever they are needed to minimize time and cost in accordance with the changing market condition is a crucial element. Although this type of outsourcing is not directly relevant to long-term value creation, the outsourcer can focus internal capacities on its core business area by outsourcing the non-core part of business to reduce time and cost, thereby increasing R & D efficiency. Several articles support the kind of values the outsourcing activities have created, as an official Medtronic spokesperson said, “…the job cuts will allow Medtronic to be more adaptive to fluctuations in market demands and maintaining service levels to our customers” (ID: M8). Also, Business Journal (2016) reported, “… industry spends thousands of dollars annually paying for travel and accommodations to train physicians on their devices…collaboration with InTouch Health enables network connectivity, hands on interaction, and an intuitive user experience” (ID: G12). In addition, the outsourcer can speed up time to market by utilizing production facilities or market accessibility of the outsourcee, as Prnewswire (2014) reported, “the business has signed an OEM agreement with Nova Biomedical Corporation to market…testing systems to hospital customers in China” (ID: J5).

Lastly, the outsourcer in type IV should be capable of sharing the core technology with the partner, whilst maintaining control over the relationship. Transferring parts of business processes or resources that are a core or complementary-to-core competence of the outsourcer could be risky, if the outsourcing partner spreads the acquired know-how to a third party and uses it to compete with the outsourcer. For this reason, the outsourcer should evaluate the detailed strategic value of the transferring resources, as well as the estimated benefits from the outsourcing, maintaining close contact with the partner. Evidence from Philips shows the expected benefits from this type of outsourcing. As an emerging market strategy, Philips explored the Russian healthcare market, utilizing the broad network of local Russian partners and infrastructure in the region, in return for supporting Russian healthcare industry by providing core resources to the local firm. Philips has improved the local healthcare system by developing products specialized in Russian under joint branding with the local partner. Ronald de Jong, CEO of Philips Healthcare said, “This unique partnership with Electron is a next step in executing on our emerging markets strategy for our healthcare sector,…will support the modernization of the healthcare system at technology, economy and even strategy levels by bringing in Philips’ global expertise to serve the real needs of the Russian healthcare system” (ID: P15). Such outsourcing strategy increased the firm’s strategic flexibility, by expanding its business to local and global markets.

To summarize this section,

Figure 7 illustrates the outsourcer’s key dynamic capabilities that are required for successful outsourcing and created value according to the outsourcing types. Also,

Table 1 briefly provides our research results supported by the case study, for each proposition suggested in

Section 4.