Abstract

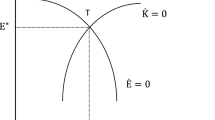

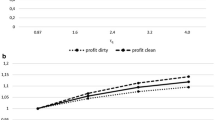

This paper analyzes tax-policy measures within a two-sector endogenously-growing economy with elastic labor supply. Pollution is either modeled as a side product of physical capital used as a production factor in the final-good sector or as a side product of production. The framework allows us to analyze the consequences of isolated tax changes or of a revenue-neutral environmental tax reform for economic growth. Although pollution does not directly affect production processes, it can be shown that a higher pollution tax as well as a revenue-neutral environmental tax reform boost economic growth, whereas a tax on capital, consumption, or labor reduces the long-term growth rate of the economy.

Similar content being viewed by others

References

Bovenberg, A. L. (1997): “Environmental Policy, Distortionary Labor Taxation and Employment: Pollution Taxes and the Double Dividend.” InNew Directions in the Economic Theory of the Environment, edited by Carlo Carraro and Domenico Siniscalco. Cambridge: Cambridge University Press.

Bovenberg, A. L., and de Mooij, R. A. (1997): “Environmental Tax Reform and Endogenous Growth.”Journal of Public Economics 63: 207–237.

Bovenberg, A. L., and Smulders, S. A. (1995): “Environmental Quality and Pollution-augmenting Technical Change in a Two-sector Endogenous Growth Model.”Journal of Public Economics 57: 369–391.

Caballé, J., and Santos, M. S. (1993): “On Endogenous Growth with Physical and Human Capital.”Journal of Political Economy 101: 1042–1067.

Devereux, M. B., and Love, D. R. (1994): “The Effects of Factor Income Taxation in a Two Sector Model of Endogenous Growth.”Canadian Journal of Economics 27: 509–536.

Gradus, R., and Smulders, S. (1993): “The Trade-off Between Environmental Care and Long-term Growth: Pollution in Three Prototype Growth Models.”Journal of Economics/Zeitschrift für Nationalökonomie 58:25–51.

Hettich, F. (1995). “The Consequences of Environmental Policy for Economic Growth: a Numerical Simulation of the Transition Path.” Diskussionsbeiträge, Serie II, 266, Sonderforschungsbereich 178, Universität Konstanz, Konstanz.

King, R. G., Plossner, C. I., and Rebelo, S. T. (1988): “Production, Growth and Business Cycles: I. The Basic Neoclassical Model.”Journal of Monetary Economics 21: 195–232.

Ligthart, J. E., and van der Ploeg, F. (1994): “Pollution, the Cost of Public Funds and Endogenous Growth.”Economics Letters 46: 339–348.

Lucas, R. E. (1988): “On the Mechanics of Economic Development.”Journal of Monetary Economics 22: 3–42.

— (1990): “Supply Side Economics: an Analytical Review.”Oxford Economic Papers 42: 293–316.

Milesi-Ferretti, G. M., and Roubini, N. (1995): “Growth Effects of Income and Consumption Taxes: Positive and Normative Analysis.” NBER Working Papers nr. 5317 National Bureau of Economic Research, Washington, D.C.

Mulligan, C. B., and Sala-i-Martin, X. (1993): “Transitional Dynamics in Two-sector Models of Endogenous Growth.”Quarterly Journal of Economics 108: 739–773.

Nielsen, S. B., Pedersen, L. H., and Sørensen, P. B. (1995): “Environmental Policy, Pollution, Unemployment, and Endogenous Growth.”International Tax and Public Finance 2: 185–205.

Siebert, H., Eichberger, J., Gronych, R., and Pethig, R. (1980):Trade and Environment: a Theoretical Enquiry (Studies in Environmental Science, vol. 6). Amsterdam: North-Holland.

Smulders, S. A. (1995): “Entropy, Environment, and Endogenous Economic Growth.”International Tax and Public Finance 2: 319–340.

Smulders, S. A., and Gradus, R. (1996): “Pollution Abatement and Long-term Growth.”European Journal of Political Economy 12: 505–532.

Uzawa, H. (1965): “Optimal Technical Change in an Aggregative Model of Economic Growth.”International Economic Review 6: 18–31.

van der Ploeg, F., and Withagen, C. (1991): “Pollution Control and the Ramsey Problem.”Environmental and Resource Economics 1: 215–230.

van Ewijk, C., and van Wijnbergen, S. (1995): “Can Abatement Overcome the Conflict between Environment and Economic Growth?”De Economist 143: 197–216.

Xu, B. (1994): “Tax Policy Implications in Endogenous Growth Models.” IMF Working Paper nr. 94-38, International Monetary Fund, Washington, D.C.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Hettich, F. Growth effects of a revenue-neutral environmental tax reform. Journal of Economics Zeitschrift für Nationalökonomie 67, 287–316 (1998). https://doi.org/10.1007/BF01234647

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01234647

Keywords

- endogenous growth

- environmental externalities

- environmental tax reform

- elastic labor supply

- optimal taxation