Abstract

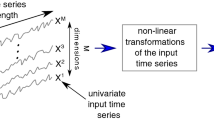

This paper is based on a recent nonparametric forecasting approach by Sugihara, Grenfell and May (1990) to improve the short term prediction of nonlinear chaotic processes. The idea underlying their forecasting algorithm is as follows: For a nonlinear low-dimensional process, a state space reconstruction of the observed time series exhibits “spatial” correlation, which can be exploited to improveshort term forecasts by means of locally linear approximations. Still, the important question of evaluating the forecast perfomance is very much an open one, if the researcher is confronted with data that are additionally disturbed by stochastic noise. To account for this problem, a simple nonparametric test to accompany the algorithm is suggested here. To demonstrate its practical use, the methodology is applied to observed price series from commodity markets. It can be shown that the short term predictability of the best fitting linear model can be improved upon significantly by this method.

Similar content being viewed by others

References

Anderson PW, Arrow KJ, Pines D (1988) The economy as an evolving complex system. Addison-Wesley Publ Comp Redwood City

Barnett AW, Chen P (1988) The aggregation-theoretic monetary aggregates are chaotic and have strange attractors: An econometric application of mathematical chaos. In: Dynamic Econometric Modelling, Barnett W, Berndt E, White H (ed) Cambridge University Press Cambridge 199–245

Baumol WJ, Benhabib J (1989) Chaos: Significance, mechanism and economic applications. Journal of Economic Perspectives 3:77–105

Brock WA, Sayers CL (1988) Is the business cycle characterized by deterministic chaos? Journal of Monetary Economics 22:71–90

Brock WA, Hsieh DA, LeBaron B (1991) Nonlinear dynamics, chaos, and instability: Statistical theory and economic evidence. The MIT Press

Casdagli M (1991) Chaos and deterministic versus stochastic non-linear modelling. Journal of the Royal Statistical Society B 54(2):303–28

Dechert WD, Gencay R (1993) Lyapunov exponents as a nonparametric diagnostic for stability analysis. In: Nonlinear Dynamics, Chaos and Econometrics, Pesaran MH, Potter SM (Eds). John Wiley & Sons

Eckmann JP, Ruelle D (1985) Ergodic theory of chaos and strange attractors. Reviews of Modern Physics 57:617–56

Eckmann JP, Kamphorst SO, Ruelle D (1987) Recurrence plots of dynamical systems. Europhys Lett 4:973–977

Farmer JD, Sidorowich JJ Predicting chaotic time series. Physical Review Letters 59:845–87

Finkenstädt B (1995) Nonlinear dynamics in Economics: A theoretical and statistical approach to agricultural markets. Lecture Notes in Economics and Mathematical Systems 426, Springer Verlag Berlin

Frank M, Gencay R, Stengos T (1988) International chaos? European Economic Review 32:1569–1584

Frank M, Stengos T (1988) Some evidence concerning macroeconomic chaos. Journal of Monetary Economics 22:423–38

Kelsey D (1989) An introduction to nonlinear dynamics and its application to economics. In: The economics of missing markets, Hahn F (ed) Clarendon Press Oxford 410–434

Liu T, Granger CWJ, Heller WP (1993) Using the correlation exponent to decide whether an economic series is chaotic. In: Nonlinear dynamics, chaos and econometrics, Pesaran MH, Potter SM (Eds) John Wiley & Sons

Lorenz H-W (1989) Nonlinear dynamical economics and chaotic motion. Lecture Notes In Economics and Mathematical Systems 334, Springer Verlag Berlin

Mood AM, Graybill FA, Boes DC (1974) Introduction to the theory of statistics, 3rd edition, McGraw-Hill series in probability and statistics

Pesaran MH, Potter SM (1993) Nonlinear dynamics, chaos and econometrics. John Wiley & Sons

Sauer T, Yorke JA, Casdagli M (1991) Embedology. Journal of Statistical Physics 65: 579–616

Sugihara G, Grenfell B, May RM (1990) Distinguishing error from chaos in ecological time series. Phil Trans R Soc Lond B 330:235–51

Takens F (1981) Detecting strange attractors in turbulance. In: Dynamical Systems and Turbulance, Warwick 1980 Proceedings, Rand DA, Young LS (Eds). Lectures Notes in Mathematics No 898. Berlin Springer-Verlag 366–81

Takens F (1993) Detecting nonlinearities in stationary time series. International Journal of Bifurcation and Chaos 3:241–256

Whitney H (1936) Differentiable manifolds. Ann Math 37:645–680

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Finkenstädt, B., Kuhbier, P. Forecasting nonlinear economic time series: A simple test to accompany the nearest neighbor approach. Empirical Economics 20, 243–263 (1995). https://doi.org/10.1007/BF01205437

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01205437

Keywords

- Forecasting nonlinear time series

- detection of low-dimensional chaos in time series

- phase space embedding, nearest neighbor prediction

- evaluation of out-of-sample forecasts by means of nonparametric testing

- agricultural price series