Abstract

The bond portfolio management problem is formulated as a multiperiod two-stage or multistage stochastic program based on interest rate scenarios. These scenarios depend on the available market data, on the applied estimation and sampling techniques, etc., and are used to evaluate coefficients of the resulting large scale mathematical program. The aim of the contribution is to analyze stability and sensitivity of this program on small changes of the coefficients – the (scenario dependent) values of future interest rates and prices. We shall prove that under sensible assumptions, the scenario subproblems are stable linear programs and that also the optimal first-stage decisions and the optimal value of the considered stochastic program possess acceptable continuity properties.

Similar content being viewed by others

References

B. Bank, J. Guddat, D. Klatte, B. Kummer and K. Tammer, Non-Linear Parametric Optimization (Akademie-Verlag, Berlin, 1988).

B. Bereanu, The continuity of the optimum in parametric programming and applications to stochastic programming, JOTA 18 (1976) 319–333.

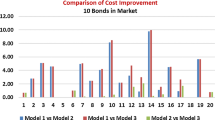

M. Bertocchi, J. Dupačová and V. Moriggia, Sensitivity of bond portfolio's behavior with respect to random movements in yield curve: A simulation study, Annals of Oper. Res. (2000), this volume.

F. Black, E. Derman and W. Toy, A one-factor model of interest rates and its application to treasury bond options, Financial Analysts J. (Jan./Feb. 1990) 33–39.

H. Dahl, A. Meeraus and S.A. Zenios, Some financial optimization models: I. Risk Management, in: Financial Optimization, ed. S.A. Zenios (Cambridge Univ. Press, 1993) pp. 3–36.

J. Dupačová and M. Bertocchi, Management of bond portfolios via stochastic programming-postoptimality and sensitivity analysis, in: System Modelling and Optimization, Proc. of the 17th IFIP TC7 Conference, Prague 1995, eds. J. Doležal and J. Fidler (Chapman & Hall, 1996) pp. 574–582.

J. Dupačová and M. Bertocchi, From data to model and back to data: A bond portfolio management problem, to appear in EJOR. (See also Technical Report 25, Univ. of Bergamo, 1997.)

J. Dupačová, M. Bertocchi and V.Moriggia, Postoptimality for scenario based financial planning models with an application to bond portfolio management, in: World Wide Asset and Liability Modeling, eds. W.T. Ziemba and J. Mulvey (Cambridge Univ. Press, 1998) pp. 263–285.

J. Dupačová and W. Römisch, Quantitative stability for scenario-based stochastic programs, in: Prague Stochastics '98, eds. M. Hušková et al. (JČMF, Prague, 1998) pp. 119–124.

E.G. Gol'shtein, Vypukloje Programmirovanie. Elementy Teoriji (Nauka, Moscow, 1970). Theory of Convex Programming, Translations of Mathematical Monographs 36 (American Mathematical Society, Providence, RI, 1972).

B. Golub, M.R. Holmer, R.McKendall, L. Pohlman and S.A. Zenios, Stochastic programming models for portfolio optimization with mortgage-backed securities, EJOR 82 (1995) 282–296.

D.H. Martin, On the continuity of the maximum in parametric linear programming, JOTA 17 (1975) 205–210.

S.M. Robinson, Stability theory for systems of inequalities. Part I: Linear systems, SIAM J. Numer. Anal. 12 (1975) 754–769.

S.M. Robinson, A characterization of stability in linear programming, Operations Research 25 (1977) 435–447.

S.M. Robinson and R.J.-B.Wets, Stability in two-stage stochastic programming, SIAM J. Control and Optimization 25 (1987) 1409–1416.

A. Seeger, Second order directional derivatives in parametric optimization problems, Math. of Oper. Res. 13 (1988) 124–139.

R.J-B. Wets, On the continuity of the value of a linear program and of related polyhedral-valued multifunctions, Math. Progr. Study 24 (1985) 14–29.

S.A. Zenios and M.S. Shtilman, Constructing optimal samples from a binomial lattice, J. of Information & Optimization Sciences 14 (1993) 125–147.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Dupačová, J. Stability Properties of a Bond Portfolio Management Problem. Annals of Operations Research 99, 251–265 (2000). https://doi.org/10.1023/A:1019275817688

Issue Date:

DOI: https://doi.org/10.1023/A:1019275817688