Abstract

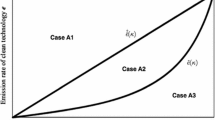

This paper shows that under an emissions tax regime where firms have heterogenous capabilities in clean technology R&D, firms can acquire technology developed by rival firms at a lower cost than developing the technology in-house. In anticipation of such second-mover advantage in R&D, this creates an investment disincentive for technological innovators and resulted in lower social welfare relative to the case where firms’ technological competencies are homogenous and knowledge spillovers are equally shared. To resolve, the government can award a targeted subsidy, instead of a standard uniform subsidy, solely to the innovator to seed research.

Similar content being viewed by others

Notes

A typical example is Australia. In 2012 the carbon tax was introduced by the socialist Labor government but was subsequently repealed by the conservative Coalition government when it assume power.

Empirically, political and transaction costs can sometimes delay or prevent policy updating. This occurs whenever preferences between environmentalists and industrial firms differ substantially and political lobbying may hinder policy changes in response to market and environmental conditions. Studies that investigates such issues on environmental policy implementation includes Zhao and Kling (2003) and Coria (2012).

One advantage of the additively separable model is that it is more tractable than the case where R&D effort impacts on the marginal abatement effort of firms so that spillovers are proportional to output, i.e., \(e(q,X_{i})=q(\bar{e}-X_{i})\), where \(\bar{e}\) as emissions per unit of output with the current technology. See Chiou and Hu (2001) and McDonald and Poyago-Theotoky (2015) for examples of the proportional model applied to environmental R&D. Petrakis and Xepapadeas (2003) have shown that the results from the additively separable model are robust to the more general model in which emissions are proportional to output.

Firm 1 is essentially a Stackelberg leader in clean R&D investment while Firm 2 is the Stackelberg follower.

An example of such one-way asymmetric R&D spillovers in clean technology is the case of photovoltaic (PV) industry in China (De la Tour et al. 2011). To conduct reverse engineering, the Chinese firms acquired technological knowledge by purchasing manufacturing equipment (particularly the turnkey production lines) produced by developed countries such as US, German, and Japan. At the same time, these Chinese firms employed highly skilled executives from the Chinese diaspora to further developed the PV systems. On the other hand, the firms in the industrialized countries did not benefit from the process innovations of the Chinese firms. In the theoretical literature, Amir and Wooders (1999, 2000) have analyzed such one-way R&D spillovers from an innovator firm to an imitator firm for cost-reducing process R&D.

Luckraz (2007) uses similar effective spillover benefits to study cost-reducing process R&D.

Gil Moltó et al. (2005) has modeled endogenous R&D spillovers where compatible R&D technologies lead the higher the spillover benefits between firms. This is relevant to model inter-industry spillovers, where the same technology can be applied across many different industries and this requires the firms to have similar R&D profiles. However, our way of modeling is more appropriate for intra-industry spillover, where the same technology is applied within firms for the purpose of pollution abatement.

The average cost of R&D for Firm 2 is given by \(AC_{2}(x_{2})=bx_{1}/x_{2}+\gamma x_{2}/2\). The marginal cost of R&D for firm 2 is given by \(MC_{2}(x_{2})=\gamma x_{2}\). Hence, for Firm 2 economies of scale for R&D will exist in the region where \(bx_{1}\ge \gamma x_{2}^{2}/2\).

In the cost-reducing process R&D literature, Cohen and Levinthal (1989) have highlighted that R&D investment has two facets: in addition to improving its own research output, the more a firm invests in R&D the better it is able to make use of the spillovers coming from other firms. In this case, we have explicitly allowed for the cost of investment in absorptive capacity to increase to allow the imitator firm to better assimilate and uses the innovating firm’s technology to reduce pollution.

Our results are robust to the alternative specification of the game where the government sets the emissions tax ex ante (the precommitment tax). It can be shown that the second-mover advantage still exists despite the innovator investing in clean technology R&D before the imitator do so. Proof are available upon request.

The second-order condition is \(\frac{\partial ^{2}\pi _{2}}{\partial x_{2}^{2}}=-\frac{11}{8}\left( 1-b\right) ^{2}-\gamma <0\). This inequality holds for \(0\le b\le 1\) and \(\gamma >0\). The required stability condition is

$$\begin{aligned} \left| \frac{\partial ^{2}\pi _{2}}{\partial x_{1}\partial x_{2}}/\frac{\partial ^{2}\pi _{2}}{\partial x_{2}^{2}}\right| =\left| \frac{5+(6-11b)b}{11(1-b)^{2}+8\gamma }\right| >1. \end{aligned}$$This stability condition is satisfied for \(0<b\le 3/11\) and \(\gamma >0\) and for \(3/11<b\le 1\) and \(\gamma \ge 1/4(-3+14b-11b^{2})\).

The second-order condition is \(\frac{\partial ^{2}\pi _{1}}{\partial x_{1}^{2}}=-\frac{189\left( 1-b\right) ^{4}+2\left( 1-b\right) ^{2}\left[ 313-b\left( 122-121b\right) \right] \gamma +16\left[ 33-b\left( 34-21b\right) \right] \gamma ^{2}+128\gamma ^{3}}{2\left[ 11\left( 1-b\right) ^{2}+8\gamma \right] ^{2}}<0\), which is satisfied for \(\gamma >0\) and \(0\le b\le 1\).

The issue is similar to the self-selection problem and Pareto efficient taxation considered by Stiglitz (1981).

In the symmetric model, the firms’ R&D investment in clean technology, R&D spillovers, and absorptive cost is similar among firms. For similar market size and for all values of R&D spillovers and its associated investment cost efficiency, the social welfare is higher compared to the current asymmetric model formulation. Proof can be provided upon request.

It could be possible to implement a lower subsidy than \(s^{**}\); however, this would be contingent on the size of the emission tax. Our purpose is simply to demonstrate that a suitable subsidy exists; thus \(s^{**}\) is sufficient (but not necessary) to satisfy the self-selection constraint.

References

Acemoglu D, Akcigit U (2012) Intellectual property rights policy, competition and innovation. J Eur Econ Assoc 10:1–42

Amir R (2000) Modelling imperfectly appropriable R&D via spillovers. Int J Ind Organ 18:1013–1032

Amir R, Wooders J (1999) Effects of one-way spillovers on market shares, industry price, welfare, and R&D cooperation. J Econ Manag Strategy 8:223–249

Amir R, Wooders J (2000) One-way spillovers, endogenous innovator/imitator roles, and research joint ventures. Games Econ Behav 31:1–25

Chiou J, Hu J (2001) Environmental research joint ventures under emission taxes. Environ Resour Econ 20:129–146

Cohen WM, Levinthal DA (1989) Innovation and learning: the two faces of R&D. Econ J 99:569–596

Coria J (2012) Taxes, permits and costly policy response to technological change. Environ Econ Policy Stud 14:35–60

D’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R&D in duopoly with spillovers. Am Econ Rev 78:1133–1137

De la Tour A, Glachant M, Meniere Y (2011) Innovation and international technology transfer: the case of the chinese photovoltaic industry. Energy Policy 39:761–770

Fischer C, Newell RG (2008) Environmental and technology policies for climate mitigation. J Environ Econ Manag 55:142–162

Forster BA (1973) Optimal consumption planning in a polluted environment. Econ Rec 49:534–545

Gil Moltó MJ, Georgantzís N, Orts V (2005) Cooperative R&D with endogenous technology differentiation. J Econ Manag Strategy 14:461–476

Grunfeld LA (2003) Meet me halfway but don’t rush: absorptive capacity and strategic R&D investment revisited. Int J Ind Organ 21:1091–1109

Hilton FH (2001) Later abatement, faster abatement: evidence and explanations from the globle phase out of leaded gasoline. J Environ Dev 10:246–265

Jaffe AB, Newell RG, Stavins RN (2003) A tale of two market failures: technology and environmental policy. Ecol Econ 54:164–174

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30:95–111

Kamien MI, Zang I (2000) Meet me halfway: research joint ventures and absorptive capacity. Int J Ind Organ 18:995–1012

Katsoulacos Y, Xepapadeas A (1996) Environmental innovation, spillovers and optimal policy rules. In: Carraro C, Katsoulacos Y, Xepapadeas A (eds) Environmental policy and market structure. Kluwer Academic Publishers, Dordrecht, pp 143–150

Kneese A, Schultze C (1975) Pollution. Prices and public policy. Brookings Institution, Washington, D.C

Leahy D, Neary PJ (2007) Absorptive capacity, R&D spillovers and public policy. Int J Ind Organ 25:1089–1108

Luckraz S (2007) Dynamic noncooperative R&D in duopoly with spillovers and technology gap. Game Theory Appl 11:139–161

McDonald S, Poyago-Theotoky J (2016) Green technology and optimal emissions taxation. J Public Econ Theory (forthcoming)

Montero J-P (2011) A note on environmental policy and innovation when governments cannot commit. Energy Econ 33:13–19

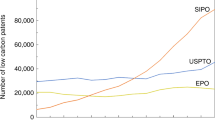

OECD (2010) Climate policy and technological innovation and transfer: an overview of trends and recent empirical results. OECD, Working Party on Global and Structural Policies, Paris

Petrakis E, Poyago-Theotoky J (2002) R&D subsidies versus R&D cooperation in a duopoly with spillovers and pollution. Austr Econ Pap 41:37–52

Petrakis E, Xepapadeas A (1999) Does government pre-commitment promote environmental innovation? In: Petrakis E, Sartzetakis E, Xepapadeas A (eds) Environmental regulation and market power. Edward Elgar, London, pp 145–161

Petrakis E, Xepapadeas A (2001) To commit or not to commit: environmental policy in imperfectly competitive markets. Department of Economics working papers 0110, University of Crete

Petrakis E, Xepapadeas A (2003) Location decisions of a polluting firm and the time consistency of environmental policy. Resour Energy Econ 25:197–214

Popp D, Newell RG, Jaffe AB (2009) Energy, the environment and technological change. In: NBER working paper series No. 14832. National Bureau of Economic Research, Cambridge

Poyago-Theotoky JA (2007) The organization of R&D and environmental policy. J Econ Behav Organ 62:63–75

Poyago-Theotoky JA (2010) Corrigendum to The organization of R&D and environmental policy. J Econ Behav Organ 76:449

Requate T (2005) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54:175–195

Requate T (2005) Timing and commitment of environmental policy, adoption of new technology, and repercussions on R&D. Environ Resour Econ 31:175–199

Scott JT (1996) Environmental research joint ventures among manufacturers. Rev Ind Organ 11:655–679

Simpson RD, Vonortas NS (1994) Cournot equilibrium with imperfectly appropriable R&D. J Ind Econ 42:80–92

Stiglitz J (1981) Self-selection and Pareto efficient taxation. In: Research memorandum No. 220, Econometric Research Program, Princeton University

Suzumura K (1992) Cooperative and noncooperative R&D in an oligopoly with spillovers. Am Econ Rev 82:1307–1320

Stern N (2006) Stern review on the economics of climate change. UK Treasury, London

Ulph A (1996) Environmental policy and international trade when governments and producers act strategically. J Environ Econ Manag 30:265–281

Zhao J, Kling CL (2003) Policy persistence in environmental regulation. Resour Energy Econ 25:255–268

Acknowledgements

The authors thank Joanna Poyago-Theotoky and the seminar participants at the Econometrics Society Australasian Meetings for their helpful comments and suggestions. Funding support from the Global Change Institute and the University of Queensland Early Career Researcher Grant is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Yong, S.K., McDonald, S. Emissions tax and second-mover advantage in clean technology R&D. Environ Econ Policy Stud 20, 89–108 (2018). https://doi.org/10.1007/s10018-017-0185-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-017-0185-6