Summary

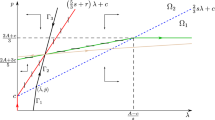

This paper provides a theory of intertemporal pricing in a small market with differential information about the realizations of a stochastic process which determines demand. We study the sequential equilibria in stationary strategies of the stochastic game between a seller and buyer. The seller has zero cost of producing one unit of a non-durable good in all market periods. The buyer's value for the good is a random variable governed by a simple Markov process. At the beginning of each period the unit's value is determined by nature and is privately revealed to the buyer. The seller posts a single price offer each period, which the buyer either accepts or rejects. Only two types of price paths emerge in equilibrium: either prices are constant, or they have persistent cycles between a low and a high value. In both cases, however, prices are “sticky” in the sense that changes in price are less frequent than changes in the economy's fundamentals.

Similar content being viewed by others

References

Border, K., Sobel, J.: Samurai accountant: a theory of auditing and plunder. Review of Economic Studies54, 525–540 (1987)

Carlton, D.: The rigidity of prices. American Economic Review76, 637–658 (1986)

Hart, O., Tirole, J.: Contract renegotiation and coasian dynamics. Review of Economic StudiesLV, 509–540 (1988)

Hayek, F. A.: Economics and knowledge. Economica4, 33–54 (1937)

Hume, D.: Of money. In: Essay. London: George Routledge and Sons (1752)

Kreps, D., Wilson, R.: Sequential equilibria. Econometrica50, 863–894 (1982)

Myerson, R.: Game theory: analysis of conflict. Harvard University Press, Cambridge, Mass., 1991

Rustichini, A., Villamil, A. P.: Learning stochastic demand in experimental markets. University of Illinois Discussion paper, 1994

Rustichini, A., Wolinsky, A.: Learning about variable demand in the long run. Journal of Economic Dynamics and Control (forthcoming)

Stokey, N., Lucas, R.: Recursive methods in economic dynamics. Harvard University Press, Cambridge, Mass., 1989

Stokey, N.: Intertemporal price discrimination. Quarterly Journal of Economics93, 355–371 (1979)

Stokey, N.: Rational expectations and durable goods pricing. Bell Journal of Economics12, 112–128 (1981)

Author information

Authors and Affiliations

Additional information

We thank John Rust and Asher Wolinsky for helpful comments. We also gratefully acknowledge financial support from NSF grant SES 89-09242.