Abstract

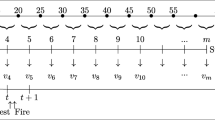

This paper is concerned with gradual land conversion problems, placing the main focus on the interaction between time and uncertainty. This aspect is extremely relevant since most decisions made in the field of natural resources and sustainable development are irreversible decisions. In particular, we discuss and develop a scenario-based multi-stage stochastic programming model in order to determine the optimal land portfolio in time, given uncertainty affecting the market. The approach is then integrated in a decision tree framework in order to account for domain specific (environmental) uncertainty that, diversely from market uncertainty, may depend on the decision taken. Although, the designed methodology has many general applications, in the present work we focus on a particular case study, concerning a semi-degraded natural park located in northern Italy.

Similar content being viewed by others

References

Adamowicz, W., P. Boxall, M. Williams, and J. Louviere, (1998). “Stated Preference Approaches for Measuring Passive Use Values: Choice Experiments and Contingent Valuation.” American Journal of Agricultural Economics 80(1), 64–75.

Arrow, K.J. and I. Fisher, (1974). “Environmental Preservation, Uncertainty, and Irreversibility.” Quarterly Journal of Economics 88, 312–319.

Birge, J.R. and F. Louveaux, (1997). Introduction to Stochastic Programming. Springer-Verlag, New York.

Bosetti, V. and V. Messina, (2002). “Modelling Flexibility in Land Allocation Problems.” to appear in Annals of Operations Research.

Bosetti, V. and V. Messina, (2002). “A Contingent Valuation Survey of Development Options for Ginostra and the Resulting Data.” http://www.life.disco.unimib.it.

Clarke, H.R. and W.J. Reed, (1990). “Land Development and Wilderness Conservation Policies Under Uncertainty: A Synthesis.” Natural Resource Modelling, 4, 11–37.

Conrad J. (2000). “Wilderness: Options to Preserve, Extract, or Develop.” Resources and Energy Economics 22, 205–219.

Coggins, J.S. and C. Ramezani, (1998). “An Arbitrage-Free Approach to Quasi-Option Value.” Journal of Environmental Economics Management 35, 103–125.

Cox, J.C., S.A. Ross, and M. Rubinstein, (1979). “Option Pricing: A Simplified Approach.” Journal of Financial Economics 7, 229–263.

Davis R.K. (1963). “The Value of Outdoor Recreation: An Economic Study of the Maine Woods.” Harvard University. Ph.D. dissertation.

Ellison E.F.D., M. Hajian, R. Levkovitz, I. Maros, G. Mitra, and D. e Sayers, (1999). “FortMP Manual”, OptiRisk Systems and Brunel University.

Gassmann, H.I. (1987). “Optimal Harvest of a Forest in the Presence of Uncertainty.” Working Paper 59 School of Business Administration Dalhousie University, Halifax, Canada.

Gaston, K.J. et al. (1998). “Conservation Science and Action.” W.J. Sutherland and C.J. Bibby (ed.), Selecting area for conservation, ch. 9.

Henry, C. (1974). “Investment Decisions Under Uncertainty: The Irreversibility Effect.” American Economic Review 64, 1006–1012.

Hoyland, K. and S. Wallace, (2001). “Generating Decision Trees for multi-stage Decision Problems.” Management Science 47(2), 295–307.

Hoyland, K., S. Wallace and M. Kaut, (2003). “A Heuristic for Moment-Matching Scenario Generation.” Computational Optimization and Applications 24, 169–185.

Klaassen, P. (1998). “Financial Asset-Pricing theory and Stochastic Programming Models for Asset/Liability Management: A synthesis.” Management Science 44, 31–48.

Koivu, M. and T. Pennanen, (2002). “Integration Quadratures in Discretizations of Stochastic Programs.” SPEPS E-PRINT SERIES, 11.

Nelson, D.B. and K. Ramaswamy, (1990). “Simple Binomial Processes as Diffusion Approximations in Financial Models.” The Review of Financial Studies 2, 393–430.

Pflug, G.C. (2000). “Scenario Tree Generation for Multiperiod Financial Optimization By Optimal Discretization.” Mathematical Programming 89, 251–271.

Piano di Settore, (2003). “Fruizione Sociale, Ricreativa e Culturale Del Parco Regionale Pineta di Appiano Gentile e Tradate.”

Scheinkman, J.A. and T. Zariphopoulou, (2001). “Optimal Environmental Management in the Presence of Irreversibilities.” Journal of Economic Theory 96, 180–207.

Smith, J.E. and R.F. Nau, (1995). “Valuing Risky projects: Option Pricing Theory and Decision Analysis.” Management Science 41, 795–816.

Spencer P. (2000). “Windfalls For Wilderness: Land Protection And Land Value In The Green Mountains,” In Cole, David N.; McCool, Stephen F. Proceedings: Wilderness Science in a Time of Change. Proc. RMRS-P-00. Ogden, UT: U.S. Department of Agriculture, Forest Service, Rocky Mountain Research Station.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Messina, V., Bosetti, V. Integrating stochastic programming and decision tree techniques in land conversion problems. Ann Oper Res 142, 243–258 (2006). https://doi.org/10.1007/s10479-006-6170-2

Issue Date:

DOI: https://doi.org/10.1007/s10479-006-6170-2