Abstract

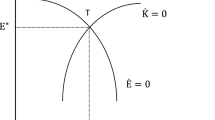

This paper studies under what conditions a ‘double dividend’ may occur in the sense that both environmental quality and employment rise. A simple static general equilibrium model is employed in which tax policy faces the dual task of internalising a negative environmental externality and raising revenue to finance public consumption. The model features a clearing labour market with both labour demand and supply and a fixed factor of production (e.g. capital). Hence, we can study tax incidence and its effect on employment, environmental quality, and the marginal cost of public funds. It is shown for the case of an upward sloping labour supply curve and less than full tax shifting by employers that a shift towards greener preferences cannot yield a double dividend, even if the fixed factor is important. However, if labour supply curve bends backwards, more environmental concern confers a double dividend.

Similar content being viewed by others

References

Atkinson, A. B. and J. E. Stiglitz (1980), Lectures on Public Economics, McGraw-Hill, London.

Auerbach, A. J. (1985), ‘The Theory of Excess Burden and Optimal Taxation’, in A. J. Auerbach and M. Feldstein, eds., Handbook of Public Economics, vol I, Amsterdam: North-Holland, pp. 61–127.

Ballard, C. L. and D. Fullerton (1992), ‘Distortionary Taxes and the Provision of Public Goods’, Journal of Economic Perspectives 6, 117–131.

Bovenberg, A. L. (1997), ‘Environmental Policy, Distortionary Labour Taxation, and Employment: Pollution Taxes and the Double Dividend’, in C. Carraro, ed., New Directions in the Economic Theory of the Environment, Cambridge University Press (forthcoming).

Bovenberg, A. L. and F. van der Ploeg (1994a), ‘Green Policies and Public Finance in an Open Economy’, Scandinavian Journal of Economics 96, 343–363.

Bovenberg, A. L. and F. van der Ploeg (1994b), ‘Environmental Policy, Public Finance, and the Labour Market in a Second-Best World’, Journal of Public Economics 55, 349–390.

Bovenberg, A. L. and F. van der Ploeg (1996), ‘Optimal Taxation, Public Goods, and Environmental Policy with Involuntary Unemployment’, Journal of Public Economics 62, 59–83.

Goulder, L. H. (1995), ‘Environmental Taxation and the Double Dividend: A Reader's Guide’, International Tax and Public Finance 2, 157–183.

Hausman, J. A. (1985), ‘Taxes and Labour Supply’, in A. J. Auerbach and M. Feldstein (eds), Handbook of Public Economics, Volume I, Amsterdam: North-Holland.

Lee, D. R. and W. S. Misiolek (1986), ‘Substituting Pollution Taxation for General Taxation: Some Implications for Efficiency in Pollution Taxation’, Journal of Environmental Economics and Management 13, 338–347.

Ligthart, J. E. (1997), Environment, Imperfect Markets, and Public Finance, Tinbergen Institute Research Series, no. 170, Thesis Publishers, Amsterdam.

Oates, W. E. (1995), ‘Green Taxes: Can we Protect the Environment and Improve the Tax System at the Same Time?’, Southern Economic Journal 61, 915–922.

Pearce, D. (1991), ‘The Role of Carbon Taxes in Adjusting to Global Warming’, Economic Journal 101, 938–948.

Ramsey, F. (1927), ‘A Contribution to the Theory of Taxation’, Economic Journal 37, 47–61.

Samuelson, P. A. (1954), ‘The Pure Theory of Public Expenditure’, Review of Economics and Statistics 36, 387–389.

Sandmo, A. (1975), ‘Optimal Taxation in the Presence of Externalities’, Swedish Journal of Economics 77, 86–98.

Terkla, D. (1984), ‘The Efficiency Value of Effluent Tax Revenues’, Journal of Environmental Economics Management 11, 107–123.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Ligthart, J.E., Van Der Ploeg, F. Environmental Policy, Tax Incidence, and the Cost of Public Funds. Environmental and Resource Economics 13, 187–207 (1999). https://doi.org/10.1023/A:1008258320732

Issue Date:

DOI: https://doi.org/10.1023/A:1008258320732