Conclusions

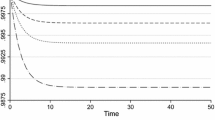

The results indicated in Table 1 show that incomplete depreciation allowances reinforce the distortions in the equilibrium growth path brought about by an ideal capital income tax. A reduction in the deductible share of economic depreciation, like an increase in the tax rate, raises the current level of consumption, but reduces the steady state levels of consumption and capital per efficiency unit of labour.

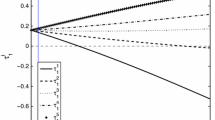

The reason for these distortions is that the tax law is able to drive wedges both between the rate of time preference and the market rate of interest, and between the latter and the marginal productivity of capital. The first wedge is created through capital income taxation as such and its size is directly related to the tax rate. The second wedge is created by the incomplete deductibility of depreciation. Its size is directly related to the tax rate and inversely to the deductible share of depreciation. For the distortion in the growth path of the economy it is the sum of the two wedges that counts. Therefore it is plausible that incomplete depreciation allowances reinforce the effects of capital income taxation.

Knowing the determinants of the two wedges one can easily derive the influence of a tax reform on the marginal productivity of capital, the market rate of interest and the rate of time preference (cf. Table 2). In the short run, the system of these three interest rates is anchored by the marginal productivity of capital, and hence any measure that widens a wedge is translated into a reduction in the rate or those rates below the wedge. In the long run the system is anchored by the rate of time preference and an increase in the width of a wedge is translated into an increase in those rates or that rate above this wedge.

Similar content being viewed by others

References

K. J. Arrow and M. Kurz (1970): Public Investment, the Rate of Return, and Optimal Fiscal Policy, Baltimore-London.

A. B. Atkinson and A. Sandmo (1980): Welfare Implications of the Taxation of Savings, Economic Journal90, pp. 529–549.

R. W. Boadway and N. Bruce (1979): Depreciation and Interest Deductions and the Effect of the Corporation Income Tax on Investment, Journal of Public Economics11, pp. 93–105.

P. A. Diamond (1970): Incidence of an Interest Income Tax, Journal of Economic Theory2, pp. 211–224.

M. Feldstein (1974a): Incidence of a Capital Income Tax in a Growing Economy with Variable Savings Rates, Review of Economic Studies41, pp. 505–513.

M. Feldstein (1974b): Tax Incidence in a Growing Economy with Variable Factor Supply, Quarterly Journal of Economics88, pp. 551–573.

M. Feldstein, J. Green, and E. Sheshinski (1978): Inflation and Taxes in a Growing Economy with Debt and Equity Finance, Journal of Political Economy86 (special issue), pp. 53–70.

R. E. Hall and D. W. Jorgenson (1971): Application of the Theory of Optimum Capital Accumulation, in: G. Fromm (ed.): Tax Incentives and Capital Spending, Washington-Amsterdam-London.

M. Intriligator (1971): Mathematical Optimization and Economic Theory, Englewood Cliffs.

M. A. King (1974): Taxation and the Cost of Capital, Review of Economic Studies41, pp. 21–35.

M. Krzyzaniak (1966): Effects of Profit Taxes: Deduced from Neo-Classical Growth Models, in: M. Krzyzaniak (ed.): The Corporation Income Tax, Detroit.

P. A. Samuelson (1964): Tax Deductibility of Economic Depreciation to Insure Invariant Valuations, Journal of Political Economy72, pp. 604–606.

A. Sandmo (1974): Investment Incentives and the Corporate Income Tax, Journal of Political Economy82, pp. 287–302.

K. Sato (1967): Taxation and Neo-Classical Growth, Public Finance22, pp. 346–370.

H.-W. Sinn (1980): Besteuerung, Wachstum und Ressourcenabbau. Ein allgemeiner Gleichgewichtsansatz, in: H. Siebert (ed.): Erschöpfbare Ressourcen, Schriften des Vereins für Socialpolitik 108, Berlin, pp. 499–528.

O. H. Schenone (1975): A Dynamic Analysis of Taxation, American Economic Review65, pp. 101–114.

V. L. Smith (1963): Tax Depreciation Policy and Investment Theory, International Economic Review4, pp. 80–91.

J. E. Stiglitz (1976): The Corporation Tax, Journal of Public Economics5, pp. 303–311.

Author information

Authors and Affiliations

Additional information

The paper was written in association with the Sonderforschungsbereich 5 (Staatliche Allokationspolitik im marktwirtschaftlichen System).

Rights and permissions

About this article

Cite this article

Sinn, HW. Capital income taxation, depreciation allowances and economic growth: A perfect-foresight general equilibrium model. Zeitschr. f. Nationalökonomie 41, 295–305 (1981). https://doi.org/10.1007/BF01287554

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01287554