Abstract

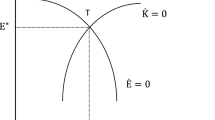

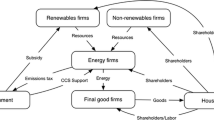

When consumers choose between clean and dirty goods and the labour market clears, a green tax reform may not bring about a double dividend in the sense of increasing environmental quality and increasing employment. However, when firms choose between clean and dirty factors of production, and when there is unemployment, such a result is very likely to occur. The paper investigates a model of a monopolistic firm where labour and energy are factors of production and trade unions negotiate the wage rate, accepting some unemployment as a result of aggressive wage demands. It is shown that, in such a framework, a green tax reform will boost employment provided it does not increase the net-of-tax wage rate by too much. This is the case when the elasticity of substitution between labour and energy is greater than one, equal to one or not too far below one.

Similar content being viewed by others

References

Allen, R. G. D. (1938). Mathematical Analysis for Economists. London: Macmillan.

Binmore, Kenneth G., Ariel Rubinstein, and Asher Wolinsky. (1986). “The Nash Bargaining Solution in Economic Modelling.” Rand Journal of Economics 17, 176–188.

Bovenberg, A. Lans. (1995). “Environmental Taxation and Employment.” De Economist 143, 111–140.

Bovenberg, A. Lans, and Ruud A. de Mooij. (1994). “Environmental Levies and Distortionary Taxation.” American Economic Review 84, 1085–1089.

Bovenberg, A. Lans, and Frederick van der Ploeg. (1994). “Environmental Policy, Public Finance and the Labour Market in a Second−Best World.” Journal of Public Economics 55, 349–390.

Bovenberg, A. Lans and Frederick van der Ploeg. (1995). Tax Reform, Structural Unemployment and the Environment, Fondazione Eni Enrico Mattei Discussion Paper No. 6/95.

Bovenberg, A. Lans, and Frederick van der Ploeg. (1996). “Optimal Taxation, Public Goods and Environmental Policy with Involuntary Unemployment.” Journal of Public Economics 62, 59–83.

Calmfors, Lars, and John Driffill. (1988). “Bargaining Structure, Corporatism and Macroeconomic Performance.” Economic Policy 6, 14–61.

Carraro, Carlo, Marzio Galeotti, and Massimo Gallo. (1996). “Environmental Taxation and Unemployment: Some Evidence on the ‘Double Dividend Hypothesis’ in Europe.” Journal of Public Economics 62, 141–181.

Dixit, Avinash K., and Joseph E. Stiglitz. (1977). “Monopolistic Competition and Optimum Product Diversity.” American Economic Review 67, 297–308.

Hamermesh, Daniel S. (1993). Labor Demand. Princeton, NJ: Princeton University Press.

Holm, Pasi, Seppo Honkapohja and Erkki Koskela. (1994). “A Monopoly Union Model of Wage Determination with Capital and Taxes: An Empirical Application to the Finnish Manufacturing.” European Economic Review 38, 285–303.

Holmlund, Bertil, and Ann−Sofie Kolm. (1997). Environmental Tax Reform in a Small Open Economy with Structural Unemployment. Working paper No. 1997/2, Department of Economics, Uppsala University.

Koskela, Erkki, and Ronnie Schöb. (1996). “Alleviating Unemployment: The Case for Green Tax Reforms.” CES Discussion Paper No. 106, University of Munich. European Economic Review (forthcoming).

Lockwood, Ben, and Alan Manning. (1993). “Wage Setting and the Tax System.” Journal of Public Economics 52, 1–29.

Nash, John. (1950). “The Bargaining Problem.” Econometrica 18, 155–162.

OECD. (1995). The OECD Jobs Study: Taxation, Employment and Unemployment. Paris.

Oswald, Andrew J. (1993). “Efficient Contracts are on the Labour Demand Curve.” Labour Economics 1, 85–113.

Schneider, Kerstin. (1997). “Involuntary Unemployment and Environmental Policy: The Double Dividend Hypothesis.” Scandinavian Journal of Economics 99, 45–59.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Koskela, E., Schöb, R. & Sinn, HW. Pollution, Factor Taxation and Unemployment. International Tax and Public Finance 5, 379–396 (1998). https://doi.org/10.1023/A:1008642512728

Issue Date:

DOI: https://doi.org/10.1023/A:1008642512728